Like the rest of the commercial real estate (CRE) industry, the Phase I environmental site assessment (ESA) market is navigating a complex landscape. For a real-world perspective on what leading environmental consultants expect in the next few quarters and the most significant challenges they face, we turned to the members of the newly formed LightBox Environmental Due Diligence Market Advisory Council. These industry leaders from environmental due diligence firms across the U.S. offer invaluable insights into the market’s dynamics at the close of each quarter.

Based on responses to the Q2 survey, these industry leaders identified the three top business challenges in the Phase I ESA market as follows:

- Forecasting the Phase I ESA Business Pipeline

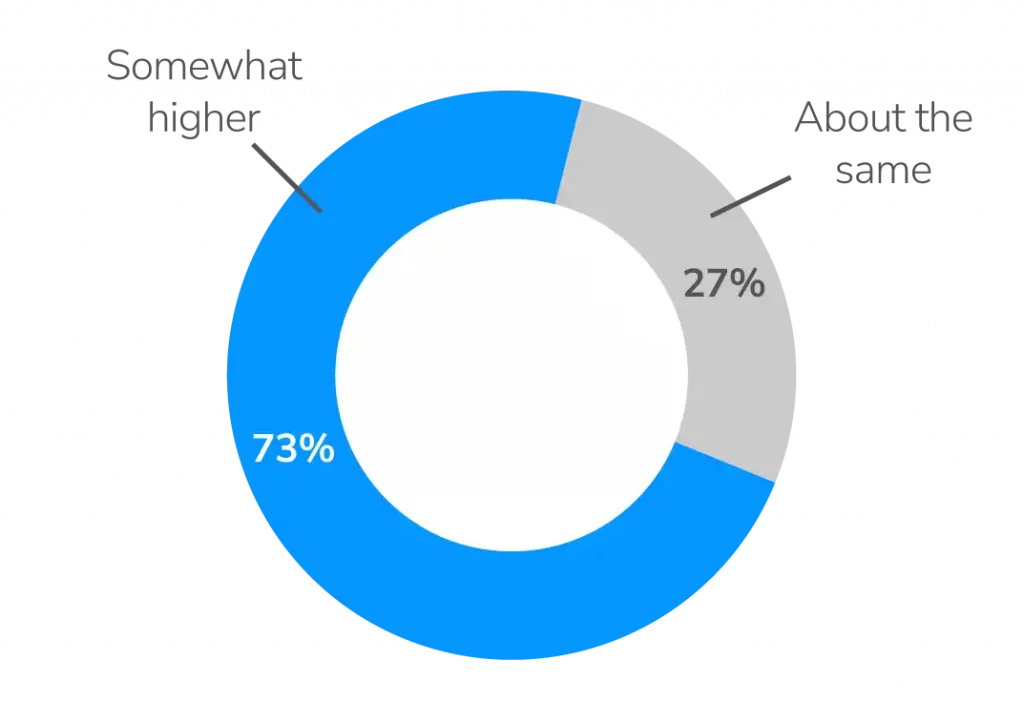

Despite overall market uncertainty, advisory council members noted recent improvements in sentiment as their clients accepted high interest rates as “the new normal” and began to explore commercial property dealmaking again. A significant majority of the Advisory Council (73%) is expecting Phase I ESA volume to increase somewhat in the third quarter and the remainder expecting no change from the second quarter. Notably, no one is expecting a decline in volume. Dana Wagner, Terracon’s VP/National Director of Due Diligence Services noted, “We have been seeing a steady increase in year-over-year proposal activity and expect this trend to continue through the remainder of 2024. However, increased price competitiveness in the marketplace is a challenge as firms strive to recover from transaction-related revenue declines in 2023.”

Environmental professionals are beginning to support opportunistic investors who are using their own capital to acquire assets, either on traditional deals or from owners facing difficulties in securing refinancing. High-profile investors like Blackstone and Goldman Sachs, who describe the current market using bullish phrases like “opportunity of a lifetime” are sending strong signals to others that the time to act is now.

Expectations for Q1 Phase I ESA volume versus Q2

Although sentiment in Q2 improved as dealmaking activity and related environmental due diligence projects began to increase, industry leaders are challenged to forecast what the coming quarters might bring. The mix of headwinds and tailwinds facing the CRE industry make it extremely difficult to estimate Phase I ESA demand over the near term.

As noted by Kathryn Peacock, Principal at Partner Engineering & Science, Inc., and Advisory Council member: “Valuation remains a challenge as deals are still not penciled out. Combined with high interest rates, this is continuing to hold deals back; however, this seems poised to change as a September rate cut is looking more and more likely. While distressed assets are not a major issue at the moment, this could also change as more loans mature and interest rates remain elevated.”

Environmental consultants are gearing up to support the necessary environmental due diligence as the CRE market continues to unravel a growing wave of maturing loans and distressed assets. A growing number of non-performing loans are being sold off in portfolios by lenders looking to mitigate their CRE risk exposure while other loans are transitioning into special servicing. Risk-averse lenders are also increasingly relying on their environmental consultants to thoroughly assess a property’s risk, sometimes requiring Phase II sampling before proceeding with a loan. The good news is that positive forces are driving new pockets of demand for Phase I ESAs, but the challenge for consultants is forecasting the extent to which business will pick up in the third and fourth quarters.

- The November Presidential Election

Council members also noted the upcoming presidential election as another significant challenge complicating the near-term forecast. Historically, it is not uncommon for elections to bring a “pause” in market activity as uncertainty leads investors to adopt a wait-and-see approach, delaying investment decisions until federal policy implications become clearer.

It seems nearly certain that the Fed will deliver the first interest rate cut at its September meeting, but any positive impact that may have on CRE investment activity is clouded by the lead-up to the November election. Adam Meurer, Senior VP, Director of Environmental Services at ECS Mid-Atlantic noted that, “Holding rates high for longer continues to complicate deal-making, but we have seen some recent improvement as the industry adjusts. While we do anticipate market improvement once rates begin to drop and confidence returns, in an election year, especially this one, there are no guarantees.”

For some, any interruption from the election is not likely to create much of a market impact. Stephen McNeil, Chief Strategy Officer at Blew & Associates sees the current uncertainty as the biggest challenge as “the increase in loans moving into special servicing, particularly in the retail and office sectors presents an opportunity for us to market our services to loan workout teams. While elections typically heighten uncertainty, historically, they have had minimal impact on job growth or real estate during election years.”

- The Implications of USEPA’s PFAS Designation for Phase I ESA Best Practices

Rounding out the list of top three challenges facing leaders in the environmental consulting sector is a technical development. Earlier this year, the U.S. Environmental Protection Agency’s (USEPA) officially designated certain PFAS (per- and polyfluoroalkyl substances) as hazardous substances under CERCLA. This development is creating significant uncertainty as consultants grapple with how best to incorporate PFAS risk assessments into their standard Phase I ESA research, adjust their processes accordingly, and advise clients effectively. It’s too soon to predict how lenders, investors and other types of clients will respond to Recognized Environmental Conditions (RECs) in their Phase I ESAs involving PFAS.

It will take time for new industry standard practices to take shape as professionals adjust to the new designation. Advisory Council member Chuck Merritt, President at Merritt Environmental Consulting Corp. noted “The biggest challenge we face is the significant uncertainty about PFAS. Everything else is a distant second.”

Brian Wilson, Managing Principal, August Mack concurred, “The uncertainty surrounding how conservative lenders, investors, and competing consulting firms will approach PFAS raises concerns. Will the widespread presence of PFAS result in a significant rise in RECs across the board, or will attention be more concentrated on properties flagged as potential source areas? Navigating this while staying compliant with the ASTM standard and maintaining competitiveness will be a key near-term challenge.”

Listen to our Environmental Due Diligence podcast for the experts’ opinions.

Looking Beyond the Challenges

In the short term, notwithstanding any significant market developments, Phase I ESA volume is likely to remain relatively flat to modestly increasing through the end of the year, assuming the Fed cuts rates at its September meeting (and possibly again later in the year), only a moderate expected disruption from the election and building on the momentum of late Q1 and Q2. Although market predictions are complicated by the wide range of uncertainties clouding the near-term forecast, it is worth noting that Advisory Council members are more optimistic at midyear than they were in Q1 with guarded optimism for more opportunities in Q3 and a potentially strong Q4.

Despite the challenges facing the Phase I ESA sector, business leaders are adapting to changing market conditions, navigating uncertainty, and continuing to provide critical support to investors and lenders. As the industry continues to evolve, staying informed and flexible will be key to overcoming the hurdles ahead and seizing new opportunities as they arise.