After a strong September return from the summer season, October’s LightBox CRE Activity Index contracted slightly, but is still well above last year. The month-over-month decline was neither surprising nor concerning, namely due to two notable factors. One, the four-year Index typically contracts slightly in October on the heels of a strong August-to-September push as the market returns from the summer lull, and September’s increase was stronger than usual, largely due to anticipation of the first rate cut. Two, the commercial real estate (CRE) market was in “wait-and-see” mode in October in advance of the November election. Election uncertainty, coupled with the elevated 10-year Treasury, is incentivizing investors to pause given the implications for CRE pricing.

As permits and construction starts for single-family housing are leading indicators for residential real estate, the CRE Activity Index is an aggregate of functions that happen in advance of CRE transactions—properties listed for sale, environmental due diligence, and lenders’ appraisals of assets prior to loan originations or refinancing. The early market reaction to the first rate cut translated into a growing comfort level on the part of sellers, borrowers, and investors in shopping for opportunities and underwriting deals.

In general, CRE activity continues to build momentum with significant disparity by asset class and geography. Properties and portfolios are trading, particularly in the Southeast region. In one notably positive development, several major October deals closed at fair market values rather than at the steep discounts of some recent downtown office transactions. With two months remaining in the year, the market is advancing cautiously as it adjusts to declining rates as well as a fair amount of uncertainty on the economic and political fronts.

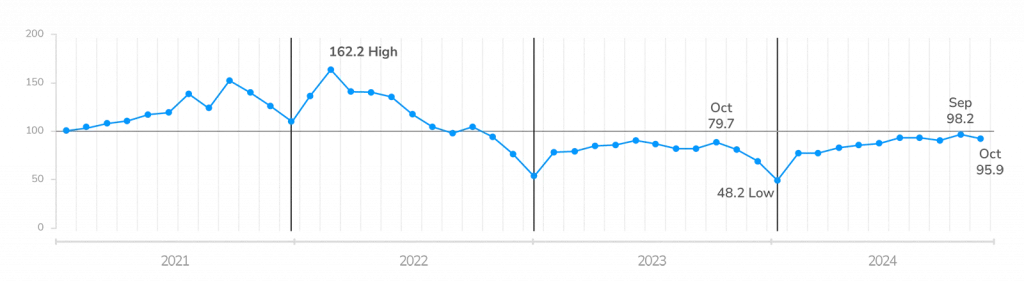

October Index a Slight 2.3 Points Below September—and 16.2 Points Above Last Year

After a bullish 8.3-point rise in September, the Index ticked down 2.3 points in October to 95.9 but landed well above 79.7 one year ago. The average daily volume of environmental due diligence activity behind the Index rose by 5% in what could signal the first round of underwriting on deals expected to close by the end of the year. Lenders’ appraisal activity month over month was stable, and property listings declined 5% after the strong 18% uptick over August, a sign of an expanding universe of available properties. The November numbers will reflect how the market responds to the expected second rate cut coming out of the mid-November Fed meeting, as well as election uncertainty receding into the rear-view mirror.

Monthly LightBox CRE Activity Index (January 2021 – Present)

CRE Treads Cautiously as Year-End Approaches

Despite the slight October dip, the CRE Activity Index heads into the final months of the year at a still-high 95.9 reading. Last year, November and December activity was lackluster as the market remained frozen at elevated interest rates with little relief in sight, ending 2023 at the Index’s four-year low of 48.2. With the November election behind us, there will be more clarity emerging on several policy issues affecting CRE finance, including taxes, housing, climate change, and bank regulations, at a critical point in the market’s recovery.

Manus Clancy

Head of Data Strategy

LightBox

“Our Index performance this month reflects both typical seasonal adjustments and broader market dynamics as stakeholders balance opportunities with election-related uncertainties. Investor confidence remains strong, but caution is prevailing as they anticipate both economic and political shifts in Q4.”

Momentum Building as Market Seeks New Normal in 2025

After a slow start to 2024, some investors are actively shopping for opportunities while others are waiting until later in the rate cutting cycle. September laid the foundation for October’s strong deal volume, which will contribute to a continued stabilization in property pricing (and even increases in values in some cases) that will add momentum to Q4 activity. The 5% increase in October’s environmental due diligence volume could be an early indicator of the wave of year-end deals getting underway. There are also signs of the lending wheels beginning to turn, but it will likely take several more rate cuts for the debt market to show any significant signs of improvement. Appraisal demand in support of refinance activity is likely to continue as rates trend downward and a growing swell of loans reach their maturity dates. Property prices are also beginning to stabilize and even rise in some sectors, marking a significant pivot point in the market cycle and signaling to investors that the time to move may finally be here.

These signs of the flywheel beginning to turn could contribute to a stronger finish to 2024 as the market establishes a new normal that will eventually stabilize at levels closer to 2019 levels. Overall, the market is showing a growing intention to transact, and CRE professionals, are exhibiting more optimism than they’ve shown in several years.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.