The latest earnings season for major tech firms reveals mixed results, sparking both skepticism and optimism. Alphabet, Amazon, Meta, and Microsoft reported strong gains in cloud and AI-driven revenue, yet their spending patterns are worrisome for the tech investor tracking earnings per share. While these firms show robust growth in cloud revenue, they also highlight the substantial investment required to bridge the infrastructure gap driven by soaring AI demand.

The message is clear: scaling AI capabilities will demand further capital and infrastructure expenditures. For the CRE investor, this is good news. The rising demand for data centers, fueled by tech giants’ need for AI infrastructure, points to an increasing demand for specialized real estate. As these companies expand data storage and processing capacities, CRE investors could see fresh opportunities in the data center sector and beyond.

Here is a closer look at how the latest tech earnings reflect the health of the industry and the potential implications for CRE investors.

Cloud is King, but Costly

Amazon, Microsoft, and Google collectively posted $62.9 billion in cloud revenue for Q3, marking a 22.2% year-over-year increase. Alphabet (Google’s parent company) blew past Wall Street’s expectations with a 15% jump in year-over-year revenue, driven by strong results in its cloud-computing division which brought in $11.4 billion of revenue. That was up 35% from the previous year.

Following Amazon’s third-quarter earnings report, CEO Andy Jassy highlighted the success of Amazon Web Services, the company’s cloud computing business, which has emerged as a major source of profits, despite the substantial expenses tied to data center investments.

Meanwhile, revenue from Microsoft’s Azure cloud segment jumped by 20% year over year, to $24.1 billion. The rapid expansion in cloud computing signals that spending by AI clients is finally starting to justify the substantial investments big tech is making. “Demand continues to be higher than our available capacity,” Microsoft Chief Financial Officer Amy Hood said on a call with analysts.

Investors have long worried that Silicon Valley may be overspending on cloud capacity betting that AI will spark growth reminiscent of the internet’s early boom. Record capital expenditures have repeatedly shaken the market, including last week when the Nasdaq Composite, dominated by tech stocks, suffered its steepest decline in almost two months.

Expanding Footprints in Data Centers as AI Spending Soars

The demand for AI infrastructure is driving record spending across tech companies, particularly in data center real estate, as they race to meet surging client needs. Amazon spent $22.6 billion on property and equipment during the third quarter, up 81% from the year before. Generative AI investments is the primary driver for the jump in spending, Jassy pointed out. In addition to investing in AI initiatives, tech firms are spending on the supporting infrastructure. This quarter alone, Amazon, Microsoft, and Google invested a total of $50.6 billion in property and equipment, predominantly for data centers to power AI workloads—a significant jump compared with $30.5 billion in the same period last year.

These spending initiatives are driving the bullish sentiment surrounding CRE opportunities in the data center sector and are already driving a new wave of industry hot spots, particularly in areas with supportive infrastructure and reliable power sources.

Google, for instance, recently announced over $7 billion in planned data center investments, with a substantial focus on U.S. facilities. Also, private equity firms KKR and Energy Capital Partners (ECP) committed $50 billion to data center and power projects, betting on AI’s heavy energy demands. Founder of ECP, Doug Kimmelman noted that “The capital needs are huge, and one of the big bottlenecks—maybe the bottleneck—is electricity availability.”

The expanding needs for energy are also driving efforts to scale up nuclear power sources, including a move by Microsoft to bring Three Mile Island back online, while Google and Amazon recently struck deals with start-ups developing smaller reactors that they hope to power up in the 2030s.

Meta’s recent $8.3 billion investment in property and equipment, primarily for AI infrastructure, underscores this commitment to technology-centric facilities. As Meta CEO Mark Zuckerberg stated, “Our AI investments continue to require serious infrastructure,” highlighting the ongoing demand for data center expansion.

Downstream Impact of Tech AI Investment: More Data Centers

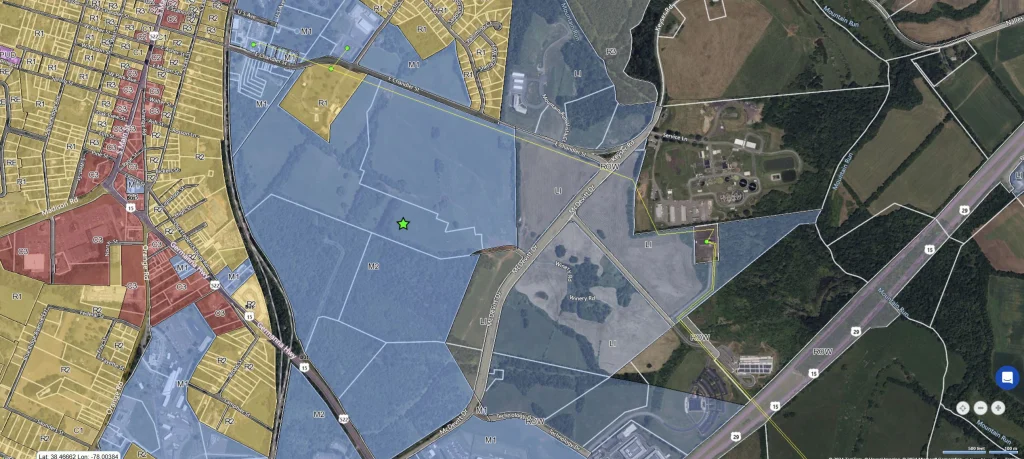

For CRE investors, this shift opens significant opportunities in regions with robust tech infrastructure, reliable energy resources, and favorable zoning for data center development. Emerging data center hubs, like Culpeper, Virginia, are particularly attractive; the town’s CTZ (Critical Technology Zone) includes a 950-acre campus, strategically located about 55 miles south of Data Center Alley in Ashburn. A new 2-million-square-foot data center campus is also underway on a 150-acre site along Route 799, adding to Culpeper’s appeal as a growing data center hub.

Office Footprints: Rightsizing Amid a Refined Post-Pandemic Strategy

While tech giants are looking to invest in CRE that presents strong opportunities for data center development, they are also recalibrating office space demand to drive efficiency and redirect resources in line with their strategic goals. Alphabet, for instance, is shrinking its worldwide office footprint to cut costs and is spending a lot of money to do so. During the third quarter of 2024, the tech giant spent $607 million to offload various office properties around the world to “generate strong revenue growth” and “improve efficiency” for “consumers, customers and creators globally,” according to the company’s earnings report. In Silicon Valley alone, the company has shed approximately 2.7 million square feet of leased office space in the past few years.

This echoes Meta’s earlier moves to reduce office space globally as part of a strategic rightsizing in response to the evolving hybrid work environment. The shift suggests that tech firms, once CRE’s biggest office sector supporters (according to CBRE), are now taking a more measured approach as they balance office needs with remote work flexibility.

For some good news on the office front, Amazon is reportedly in talks to lease between 60,000 and 80,000 square feet at the under-construction Wynwood Plaza, in Miami, Florida, highlighting another trend within the office sector: more selective office expansion to key tech markets like Austin, Seattle, and San Francisco rather than holding widespread office footprints.

Tech’s Health Outlook and CRE’s Strategic Opportunity

The latest tech earnings point to robust growth in AI and cloud applications, but also highlights a move by these major players to right-size their office holdings and leases. For CRE, these insights present a mixed bag: while traditional office leasing may remain subdued, data centers and strategically located office hubs are poised for steady growth. The tech sector’s continued strength in cloud revenue and AI investments signals long-term demand for high-tech CRE solutions that support AI, cloud, and energy needs, pointing to an evolution in tech’s role within the real estate sector.