The third quarter of 2024 continued the trend of slow growth in lender-driven appraisal demand observed in the previous two quarters. In the past few months, the Federal Reserve has made two interest rate cuts; a bold 50-basis-point (bps) reduction in the third quarter, followed by another 25-bps-cut on November 7th. While these cuts have sparked cautious optimism as we approach year-end, they may not necessarily signal the start of a sustained rate-cutting cycle, given the uncertainty surrounding the potential economic implications of a Trump 2.0 presidential agenda and its influence on future Fed decisions. For now, declining rates are offering some relief to borrowers facing “cash-in” refinancing challenges, enabling access to capital on improved terms and supporting appraisal activity tied to refinancing.

The trends observed in Q3 2024 will have several implications for appraisers as they navigate an evolving commercial real estate (CRE) market:

- Increased Demand for Appraisals

2024 has been anything but a typical year, with month-over-month fluctuations—such as the usual spikes in June and September—not necessarily holding true. Instead, the overall trend reflects a slow move back to a new normal in appraisal activity. The 18.3% year-over-year increase in appraisal activity suggests growing demand, driven by selective lending and the approaching maturity of loans taken during peak market conditions. As more loans reach their maturity dates and refinancing becomes necessary, appraisers will see an influx of appraisal requests, particularly as borrowers seek updated valuations to secure refinancing under more favorable terms.

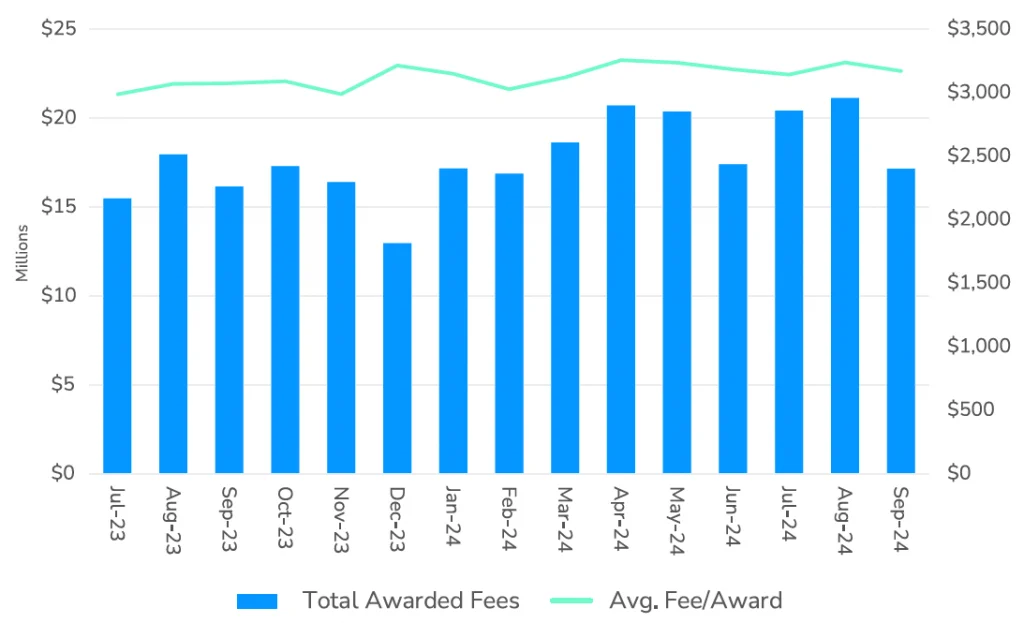

Avg. Fee/Award & Total Awarded Fees Through Q3 2024

- Pressure on Fees and Turnaround Times

Despite the rise in demand, appraisers continue to face pressure on fees and turnaround times. In Q3, average fees slightly decreased compared to Q2, even though they rose 5% year-over-year. This signals ongoing competition among appraisers, with lenders pushing for faster turnaround times at lower costs. The compression of the average turnaround time to 13.3 days from 14 days in Q2 indicates that appraisers must continue to increase efficiency without sacrificing quality. - Complexity Due to Interest Rate Cuts

The Federal Reserve’s decision to cut interest rates was a long-expected move and thus potentially having less impact since it had already been incorporated into most pricing estimates. While lower rates could spark a rise in transactions and refinancing, appraisers must carefully assess the impact of these rate cuts on property values. Lower borrowing costs may relieve some financial pressure on property owners, but appraisers will need to account for other factors, such as inflation and long-term income potential, when determining property values. - More Specialization by Asset Type

The sharp rise in appraisal activity for agricultural properties (23.6% growth from Q2) and continued strong demand for retail, industrial, multifamily, and office assets suggest that appraisers will need to specialize in these sectors. Each asset class faces unique challenges—such as vacancy rates, operating costs, and rent growth—which appraisers must navigate when making accurate valuations. Additionally, the bifurcation in office space demand and the risks faced by multifamily properties will require appraisers to be particularly diligent when working with these property types. - Assessors Play Key Role in Recovery

As the market begins to recover and transactions increase, appraisers will play a pivotal role in informing key decisions for sellers, lenders, and investors. Their valuations will set the benchmark for pricing properties in a recovering market, especially as distressed assets come into play. However, the elevated 10-year Treasury yield continues to create uncertainty, giving the market an excuse to continue their wait-and-see approach, which has implications for CRE pricing.

“Appraisers are navigating an especially challenging landscape right now, with suppressed transactions driven by a wide bid-ask spread and fewer trades to rely on for comparables,” said Eric Enloe, senior managing director at Partner Valuation Advisors, during The CRE Weekly Digest podcast. “While there is movement toward more transactions, appraisers must go beyond the numbers, leveraging listings, broker insights, and market sentiment to deliver valuations that truly reflect current conditions.” This environment makes appraisers’ insights even more critical for shaping lenders’ decisions on refinancing requests, new loan originations, and property portfolio assessments.

As the market gets more clarity on the future path for interest rates, sentiment will improve, and buyers and sellers will be better equipped to pencil out deals in a way that they couldn’t earlier in the year. What should follow is a period of more pricing certainty, greater access to capital, more transactions, and a renewed cycle of redevelopment as CRE continues to respond to evolving demand for space.