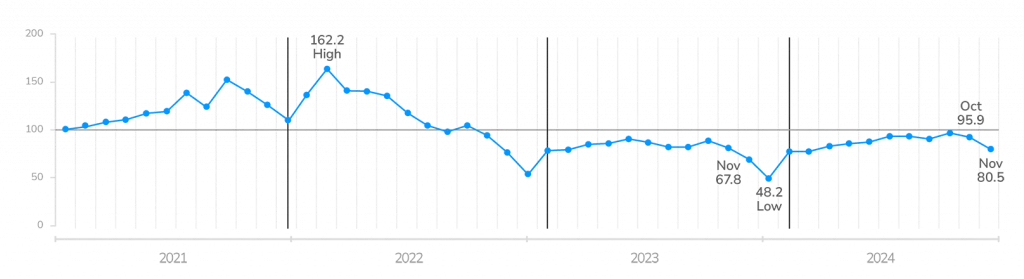

In a typical year, the LightBox CRE Activity Index hits a September peak then winds down through year-end, and 2024 was no exception. With the anticipated month-over-month decline in November, the Index came in at 80.5, 15.4 points lower than the October reading, but 12.7 points higher than the same period last year when the market was frozen with persistently high rates.

November delivered the welcome news of the second interest rate cut by the Fed and the end of a contentious election season. As with other leading indicators like permits in the residential sector or architectural billings in the construction segment, the LightBox CRE Activity Index is an early indicator of the market’s collective CRE dealmaking velocity as an aggregate measure of activity across critical functions conducted before deals close: properties listed for sale, environmental due diligence, and commercial appraisals.

Leading up to the first interest rate cut in mid-September, the Index was showing signs that the flywheel of CRE activity was starting to finally build momentum after a long period of sluggishness. The long-awaited transition to lower rates triggered a noticeable shift in sentiment, fueling a new sense of optimism, albeit guarded. Environmental due diligence consultants are seeing early signs of stronger activity from clients that had largely been on the sidelines in the first half of 2024 awaiting lower rates. The wide bid-ask gap that thwarted deals continues to narrow, and sellers are more willing to list properties as institutional investors move in to chase early opportunities. Appraisals are in demand as a precursor to lending and refinance activity, which is also on the rise. These are the key market factors that drove November’s Index higher than last year’s low. In the final inning of 2024, the CRE market is in a period of adjustment and speculation about the timing of future rate cuts and the policies taking shape under the new administration.

November Index Falls to 80.5 but Remains Higher than 2023 as Year-End Approaches

With the anticipated month-over-month seasonal decline in November, the Index came in 15.4 points lower than the October reading. The Index began its decline in October with a slight 2.3-point drop to 95.9. For the past three years, the October to November decline has averaged 14.7 points. This year’s slightly steeper decline was likely a function of market uncertainty reflected by recent volatility in the U.S. 10-year Treasury yield as investors assessed the outcome of the November election.

More encouraging, however, is the dramatic improvement year over year. The November Index landed 12.7 points above 67.8 one year ago. Behind the uptick were double-digit increases in velocity across all three CRE activity indicators (property listings, appraisals, and environmental due diligence). One year ago, rates were locked at high levels, lenders held fast to the reins, and sellers were reluctant to list properties given the high degree of pricing uncertainty. Despite the seasonal decline, November’s Index is an encouraging sign that sellers are more comfortable listing properties, appraisers are seeing more projects to support lenders’ originations or demand for refinancing maturing loans, and environmental due diligence consultants have more projects in the pipeline to assess potential risk exposure prior to new loans, property sales, and refinancing.

Monthly LightBox CRE Activity Index (January 2021 – Present)

OUTLOOK: Guarded Optimism Prevalent as Market Prepares to Turn the Page to 2025

Given that the major obstacles to 2024’s CRE transactions and lending volume (i.e., high interest rates, election uncertainty, and a wide bid-ask gap between buyers and sellers) have all improved, the CRE Activity Index ended November in a better position at 80.5 than last November’s 67.8, and December is unlikely to fall below last year’s three-year low point (see chart). Although the CRE market is not without challenges, the continued strength of the U.S. economy, strong pockets of demand across CRE, and the availability of capital from willing lenders all bode well for healthy CRE investment and lending over the near term.

CRE Lending Finding Its Footing

Anyone frustrated by the slow pace of loan originations and refinancing in the first half of 2024 can take solace in the fact that CRE credit markets are picking up momentum. In mid-November, the Mortgage Bankers Association (MBA) released its Q3 report showing a dramatic 59% quarter-over-quarter increase in commercial and multifamily mortgage loan originations. Lenders are more open to development and construction financing than they have been in recent years, and private equity is actively stepping in with aggressive plans for growing their lending portfolios and filling the void left by traditional banks. Over the near term, the MBA is forecasting that CRE debt originations will increase from $429 billion in 2023 to $665 billion by the end of 2025 both from new originations and as refinancing needs come to the fore. While continued volatility in the Treasury yield could disrupt a consistent trajectory, a Fed stance of easing monetary policy should spur stronger lending and refinancing activity into next year.

Opportunistic Investors Hunt for Early Deals

Demand for strong CRE assets is grounded in trends like the explosive growth of the digital economy, the work-from-home dynamic, and the repurposing and redevelopment of space, especially in the office and retail sectors. Slowly, as interest rates decline, the math behind CRE transactions will start to pencil out better than they have in several years, which is hugely important to investors. Any meaningful uptick in transaction volumes, however, is not likely to materialize until early to mid-2025 given the market lag in response to interest rate shifts.

Near-Term Unknowns Cloud a Bullish Forecast

While the near-term forecast is largely positive, headwinds remain. Among them is the threat of inflation, a weakening in the labor market, the unknown path of monetary and other policies at the federal level that will impact CRE and increasing geopolitical risks. The LightBox CRE Activity Index is evidence that the market is baby stepping its way back to recovery as it responds to dynamic market conditions. November is typically a slow month, but anecdotally investors are displaying a greater intention to allocate capital into U.S. CRE investment.

Manus Clancy

Head of Data Strategy

LightBox

“With clearer signs on the horizon regarding lower interest rates and the new administration’s policies, we’re seeing signals of increased lending and investment sales activity in 2025. While economic and political uncertainties remain, November’s data shows that well-capitalized investors are still pursuing opportunities in key asset classes and markets, and borrowers are securing financing for the right deals.”

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.