The Latest Data, News, and Analysis Impacting the Commercial Real Estate Market

Every week, LightBox carefully selects the week’s most impactful economic news, market metrics, in-house data and analysis, and transactions shaping the CRE industry.

In This Week’s Edition:

- New Round of Economic Data Raises Red Flags

- Housing Market Faces Headwinds as Sales and Construction Slow

- AI Leader’s Financial Results Highlight Demand for Data Center Infrastructure

- Office Market Faces Value Declines as Investors Circle for Opportunity

- REITs Eye Strong Retail Opportunities

1. New Round of Economic Data Raises Red Flags

The latest round of market data painted a picture of growing uncertainty and raised fresh concerns about the economy. Among them, the Conference Board’s consumer confidence survey declined more than expected, landing at 98.3 in February, a seven-point decline below January that was reflective of eroding optimism about jobs, income, and general business conditions. Labor market data out last week also suggested potential signs of economic softening with jobless claims increasing 22,000 to 242,000 over the prior week. Investors are increasingly concerned about tariffs on imports from Mexico and Canada that are scheduled to go into effect on March 4, as well as last week’s announcement of a 25% duty on imports from the European Union.

After a drop from mid-month highs of 4.63%, the benchmark 10-year Treasury yield started last week at 4.40% and fell to a new 2025 low of 4.28% by week’s end, driven by growing concerns over the economy and the impact of federal policy changes.

Market watchers eagerly awaited the main data release of the week—the personal consumption expenditures index, the Federal Reserve’s preferred inflation gauge. The PCE Index rose 2.5% on an annual basis, in line with economists’ expectations and delivering some reassurance after the hotter-than-expected CPI data earlier this month. Core PCE (which excludes volatile food and energy costs) rose 2.6% in the 12 months through January, an encouraging moderation from December’s 2.8%.

The LightBox Take: In response to this week’s news, interest rate cuts this year are back on the table. After predicting no rate cuts this year just a few weeks ago, markets reverted to fully pricing in two Fed rate cuts this year—one in June and the other in December—amid growing worries of an economic slowdown. On the heels of slumping confidence, higher jobless claims, and concerns about the first round of tariffs, the late-week inflation report showing inflation slowing to its lowest level in seven months came as welcome news to a jittery market just a few weeks before the next Fed meeting on March 18-19.

2. Housing Market Faces Headwinds as Sales and Construction Slow

The U.S. housing market is showing signs of strain, with the latest round of data showing new home sales dropping to a three-month low in January and housing starts plummeting 9.3%—the steepest decline in 10 months. Mortgage growth also remains sluggish, increasing just 1.6% year-over-year in Q4 2024, the weakest pace in three years. Meanwhile, residential mortgage delinquencies rose to 1.66%, the sharpest quarterly increase since 2020. On the construction side, single-family starts fell 4.7% in January, while multifamily dropped 24.2%, signaling declining builder confidence and concerns about tariffs. President Trump’s proposed tariffs on imports from China, Canada, and Mexico could increase the cost of imported construction materials by $3-$4 billion. For materials where imports are a critical part of the supply chain, the imposition of tariffs could lead to significant price spikes that would hinder homebuilders’ ability to deliver new projects. A recent LightBox blog highlighted the mounting pressures facing the homebuilding sector as it enters the critical spring selling season.

The LightBox Take: A cooling housing market is another potential sign of growing economic weakness given that declining home sales and construction slowdowns can drag on GDP growth as housing contributes significantly to economic activity through job creation, consumer spending, and material demand. Rising mortgage delinquencies and weaker builder sentiment can also indicate growing financial stress. An ancillary impact is that the multifamily segment could see stronger demand if more intense home affordability pressures and limited new home construction force more would-be homebuyers into the rental market.

3. AI Leader’s Financial Results Highlight Demand for Data Center Infrastructure

The latest earnings report from NVIDIA delivered evidence of the growing demand in the AI sector for data center infrastructure. The company posted a strong 93% year-over-year increase in data center revenue to $35.6 billion, with major cloud providers accounting for half of the total. However, profit margins are tightening (and equity investors reacted) as AI models demand more computing power, driving up equipment costs and operating expenses. Meanwhile, Apple announced a $500 billion U.S. investment that underscores AI’s expanding footprint in CRE. Plans include a 250,000-square-foot AI server facility in Houston, expanded R&D, and new data centers across several states.

The LightBox Take: NVIDIA’s growth in data center revenue, coupled with Apple’s bullish investment in Houston will keep data centers on CRE investors’ radar, and Houston, already a strong CRE market, will likely benefit from demand for other types of real estate, including multifamily housing due to an influx of new employees. As AI models grow more sophisticated, the need for high-performance computing power is driving expansion in cloud infrastructure and data center developments. This, in turn, is fueling demand for industrial space, power infrastructure, and construction services. The halo effect extends to office, multifamily, and retail in emerging tech hubs as jobs and capital flow into these markets.

4. Office Market Faces Value Declines as Investors Circle for Opportunity

The office sector continues its ongoing struggle with national vacancies rising 180 basis points to 19.7% in 2024, according to a new report from Yardi. Total U.S. office sales fell 11% year over year, and average prices for office assets have plunged 37% since 2019. Despite these annual trends, signs of stabilization are emerging, and some metros—including Manhattan, D.C., Los Angeles, and Boston—experienced higher transaction volume last year compared with 2023. The latest wave of office deals is driving new interest from other investors sensing it’s time to pounce, especially on distressed assets with strong ROI potential. Namdar Realty Group, known for acquiring zombie malls, is betting big on the return-to-office trend and has been actively acquiring office buildings at deep discounts. Since 2021, Namdar has purchased 10 prime office buildings for a total of more than $480 million in Chicago, Cleveland, and NYC.

The LightBox Take: Much of the value decline in office stems from record high vacancy rates in a post-COVID market. With the national average approaching 20% at year end, concerns are growing about the adverse impact that the latest round of federal lease terminations could have. Washington, D.C., with a 23% office vacancy rate, will take another hit from lease terminations just when the market was starting to show signs of improvement with higher leasing and sales activity late in 2024. As federal agencies vacate space, it could be challenging for owners to find replacement tenants—especially for aging buildings, adding pressure to an already struggling sector. Adaptive reuse, including conversions to multifamily, mixed-use, or life sciences, could help stabilize the market over time, and new return-to-office mandates may drive new leases for space and improve vacancy rates in other struggling office markets outside of D.C.

5. REITs Eye Strong Retail Opportunities

The retail landscape continues to evolve, with Starbucks announcing 1,100 corporate layoffs to streamline operations, with Joann and Forever 21 joining the big retail brands announcing widespread store closures. Meanwhile, shopping center investment remains active, with Federal Realty acquiring the Del Monte Shopping Center in Monterey for $123.5 million, $8.5 million above the previous sale price in 2004. Despite headwinds, retail REITs remain optimistic. Simon Property Group, Kimco, Regency, and Federal Realty all reported leasing activity at or near record levels that delivered high occupancy rates and rent growth. The Del Monte deal came on the heels of Federal Realty closing 100 deals in Q4 alone, pushing occupancy to 94.1%.

The LightBox Take: Despite high-profile closures like Forever 21, which is expected to close all 350 of its stores, retail investors are optimistic and actively scouting out opportunities to invest in well-located shopping centers with stable cash flow and long-term upside. Interest in grocery-anchored centers and experiential retail remains high, while struggling properties may present value-add opportunities.

Important dates and industry events this week

- Monday, March 3:

- Manufacturing PMI, construction spending

- March 3-4:

- The LightBox team is headed to Environmental Professionals of AZ Conference (Tempe, AZ)

- Wednesday, March 5:

- Services PMI, factory orders, Fed Beige Book

- Thursday, March 6:

- Initial jobless claims, US productivity

- Friday, March 7:

- Jobs report, unemployment rate, hourly wages

Did You Know of the Week

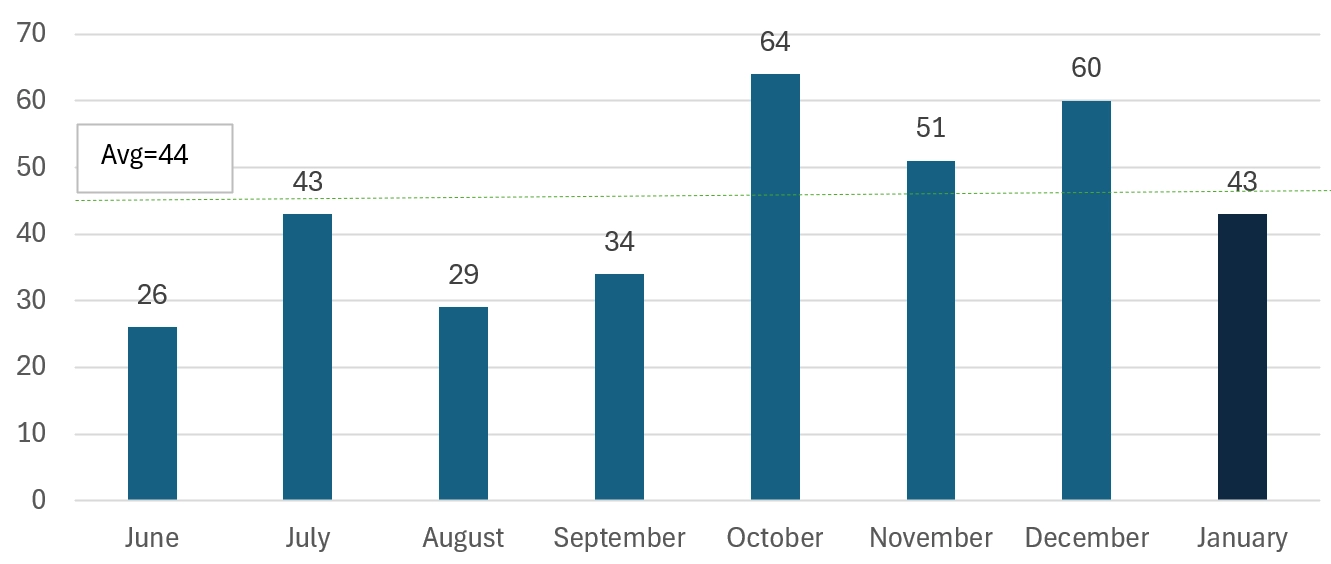

Did You Know that LightBox tracked 350 deals of $100 million or more that closed over the past eight months? January’s total came in at 43 deals, just below the eight-month average of 44. A review of recent buyers also revealed very few repeat investors. Instead, each month’s deals reflect a new universe of buyers as those with equity or debt capital targeting U.S. CRE move into action. Property listings on the LightBox RCM platform declined in November and December but surged in January, setting the stage for the next wave of major deals in February and March.

Total Number of CRE Transactions Over $100 Million

(June – December 2024)

This week, a trio of LightBox experts—Manus Clancy, Tina Lichens, and Dianne Crocker—presented a webinar, Q4 2024 CRE Recap & Early 2025 Trends, covering Q4’s key trends, early Q1 metrics, and the near-term forecast. If you missed it, the replay is available here.

For more insights on commercial real estate data and trends, subscribe to Insights and the CRE Weekly Digest Podcast for commentary and real-time data.