AUTHOR: Kathy Satterfield

This was a topic of discussion initiated by a group of more than 200 Phase I ESA professionals from across the country, brought together by a shared belief that the environmental due diligence industry lacks a unified voice. In January 2012, these environmental professionals formed the Phase I Environmental Consultants Roundtable (ECR) to “function as an information gathering and dissemination forum” in the hope that “by working together to provide a consistent message on industry practice, they will improve the status of the industry and better educate clients.” At its meeting in October 2012 at the ASTM meeting in Atlanta, ECR members made presentations on key topics identified by the group as important to the industry, but which have not been specifically addressed in the ASTM E1527 Phase I standard. The ECR report, titled “What You Need to Know as a Phase I Environmental Professional That is not in the ASTM E1527 Standard,” is a summary of the discussion on 12 issues of concern being addressed by the group. This Technical Brief is the third in anew LightBox EDR® Insight series that will be tackling each issue individually. Below is the content from the white paper, interspersed with feedback provided to LightBox EDR® Insight by environmental professionals in the field.

Growing Demand for Reliance Letters

A major concern of the ECR is the growing trend toward “open reliance,” often a requirement on Phase I ESA projects in the commercial mortgage backed securities, or CMBS, sector. “Open reliance,” while an overly broad definition, is often used in the marketplace to represent situations in which individuals not specifically permitted by the environmental professional to rely on a Phase I ESA report would be able to. Traditionally, and as is the case for nearly all professional consulting services, only the client for whom the Phase I ESA report was originally conducted could rely on it. If the client wanted someone else to rely on the report, this was usually allowed so long as the original client agreed and waived conflicts of interest claims, and the party needing to rely on the report signed off on:

- the scope of work conducted (reflecting among other things on the original client’s risk tolerance);

- the limitations in the report; and

- the consultant’s terms and conditions (including limitations to total liability).

The emergence of the CMBS industry created an extremely large demand for reliance by a broad list of parties associated with lending or securitization activities. Consultants were being asked or required to convey rights of reliance to unnamed or undefined parties that might rely on the report subsequent to the original service and client. This “open reliance” was an accommodation that was printed on the front cover of most Phase I reports generated to support a CMBS issuance. The habit of extending “open reliance”became so commonplace that it is often still expected today, even for non-CMBS deals, and well after CMBS activity crested. For liability reasons, many consultants in the industry today refuse to work for clients requiring “open reliance.”

Jeff Hullinger, P.E., of Carnoustie Consulting, Ltd. say sthat his Ohio-based firm provides reliance letters out of necessity. “We’d rather not have to, of course, but our clients need loans and their lenders require the letters, so we have little choice if we want to be of service.”While Hullinger’s firm provides the letters, it is wary of the implications involved, as are many consultants who refuse to even issue them. “They’re essentially ‘permission to sue’ letters,” Hullinger says.

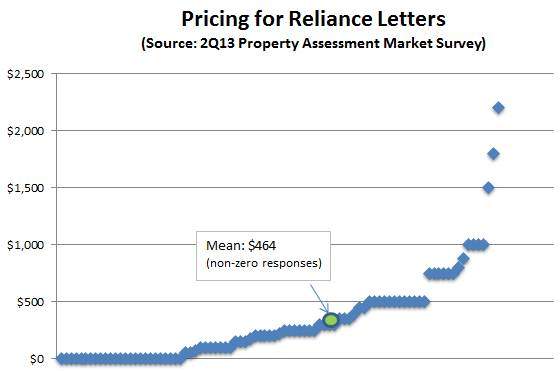

Pricing for Reliance Letters

A fee is often charged for granting reliance, thus meeting the contractual precept of consideration and offsetting administrative costs.The fees can vary, often times a function of the relationship between the firm and the client.

“For most clients whom we routinely serve, we build extra [dollars] into our fee if we know they’ll be asking for reliance letter(s)—usually they tell us ahead of time,” says Hullinger. “It’s typically $200 or so, though for a client we don’t have a track record with, the fee might be as much as $500 to compensate us for the added exposure.”

The results of the LightBox EDR® Insight 2Q13 State of the Property Assessment Market Survey of Environmental Professionals support that it is common in the industry for consultants to extend reliance letters—but only when working with good long-term, repeat clients or in cases where the relying parties are limited in number and well-known to all parties involved in the original deal. In fact, 80% of respondents to the 2Q survey work at firms that provide reliance letters. Most are very reluctant to do so and only provide them when absolutely necessary. For example, many conduct environmental due diligence for the U.S. SBA, which requires reliance letters for all transaction screens, Phase I ESA and Phase II ESAs under its environmental policy, SOP 50 10 5(E). The LightBox EDR® Insight 2Q13 survey also asked about pricing for reliance letters. Of those who issue reliance letters, 27% do so at no charge. Of those who do charge, prices ranged from a low of $50 to a high of $2,200. The average fee across non-zero responses was $464.

How to Protect Yourself

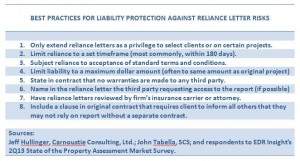

Acknowledging the reality that there will be projects that require “open reliance,” ECR workshop participants suggested putting a time limit on reliance and requiring those desiring to rely on the Phase I ESA report in the future to sign off on the scope of work conducted, the limitations in the report, and the consultant’s terms and conditions. If a party wants to rely on a Phase I report at some future time, they must affirmatively agree to the contract terms (including the scope of work, terms and conditions, limitations and assumptions) in writing to the consultant who performed the Phase I ESA project. It was also suggested that all reports include such a model letter so that prospective future relying parties could easily complete a conforming reliance request—or see how requests/demands for “open reliance” differ from conventional consulting contract forms. Concern was also expressed in the ECR’s report that property buyers and investors may rely on reports intended to support lending decisions. This could represent a potential conflict of interest situation if a Phase I is performed to support a lending decision, but which could then be used by prospective purchaser to support a property acquisition decision.

There are a number of steps that consulting firms take to protect themselves from the liability associated with reliance. A consultant in California wrote in a commonground discussion thread on the topic: “Our contract includes a clause requiring our client to inform all others that they may not rely on our report without having a contract with us, and our reports all include a reliance contract [that] other parties may execute and send with payment to us. Just a disclaimer that others may not rely on it does not seem adequate, and others here have reported being sued by third parties who tried to rely on their reports.” The post continued, “All of our contracts also include a mandatory binding arbitration clause and other features to protect us from frivolous lawsuits, legal fishing expeditions, and other such [efforts].”

Hullinger says his firm doesn’t “really have a formal liability-exposure limitation policy.” Instead, “If a client asked us for reliance to be extended and we had reason to believe they [were] litigious,we’d probably refuse,” he says.

Proactive Protection

Requests/demands for reliance letters will not go away; however, EPs must be smart in how they respond to these requests and under what conditions.Everyone that relies on the Phase I report, or those who could foreseeably rely on the report, must ultimately be viewed as a source of claims against the consultant. That is one reason to involve legal. John Tabella, of SCS, says his firm provides reliance letters, using “a preferred form that our legal department has approved that includes things like sunset clauses, limits of liability (in line with the contract with our client), etc.If the third party has their preferred form/language, we’ll review and have our legal staff review it, if necessary. As such, we’ll often ask to be compensated for this, which may be several hundred dollars to $1,000 or more, depending on the site, conditions and risks. Otherwise, if SCS’s form is acceptable and we have a good understanding of the site, we’ll provide our standard reliance letter, often at no charge, particularly if the relying party is someone we know.”

“One other thing I like to see in reliance letters is a specific third party named, rather than an overly broad universe of parties (e.g., ‘all successors and assigns’). Sometimes though, this just isn’t possible,” continues Tabella.

***

NOTE TO READERS: EDR® Insight would like to thank Jeff Hullinger and John Tabella for sharing their valuable insights for this brief.

***

About the ECR

The report, titled What You Need to Know as a Phase I Environmental Professional That Is Not in the ASTM E1527 Standard, is a summary of the discussion on key topics prepared by individuals who volunteered their time to make presentations and provide discussion leadership at the ECR workshop held on October 23, 2012 in Atlanta, GA. It is not meant to represent a Roundtable consensus of opinion, nor approval by the report preparers. The Phase I Environmental Consultants Roundtable meets four times per year, in conjunction with the spring and fall ASTM meetings and winter and summer Environmental Bankers Association meetings. To learn more about the Roundtable, including its mission and objectives, visit the Roundtable’s web site on commonground where a separate area has been set up to share information and collect feedback from the entire Phase I industry. The presentations used as the basis for workshop discussion can be reviewed and downloaded from the Phase I Environmental Consultant Roundtable website. To become a site user, you must be a member of the commonground community (click Join on the site to obtain a password). Comments and feedback can be submitted directly on the web site under the appropriate category. There is no cost to become a member of the Roundtable.

***