The homebuilding industry continues to face challenges marked by high interest rates, construction costs, and other macro factors that have put downward pressure on new home sales. New home construction ticked up 3% in June (to an annual rate of 1.3 million units) buoyed by a surge in multifamily projects, according to the U.S. Department of Housing and Urban Development. Housing starts for single family homes dropped 2.2% while multifamily starts rose 19.6%.

Building permits, a sign of future construction mirrored that divergence. Overall permits rose 3.4% to a 1.45 million annual rate, but under the headline number was a different story. Single-family permits decreased 2.4% while multifamily permits increased 15.6%.

Overall, both starts and permits were lower than one year ago (4.4% and 3.1% respectively). Against the backdrop of elevated rates, all this contributed to the drop in builder sentiment in July. Builder confidence fell for a third straight month to 42 in July, marking the lowest reading since December 2023, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). NAHB Chairman Carl Harris attributed this decline to high mortgage rates, labor shortages, and a lack of buildable lots.

Despite this challenging market, some homebuilders are reporting positive gains and beating expectations, thanks to strategic pricing activities aimed at counteracting the impact of 7% mortgage rates (which tipped above 7% the first week of July), and elevated labor and financing costs, which have significantly dampened builder confidence.

Builders Show Resilience

In July, 31% of builders cut home prices to boost sales, up from 29% in June, with the average price reduction holding steady at 6% for the 13th consecutive month, according to the NAHB. Additionally, 61% of builders used sales incentives to attract buyers, matching the previous month’s level. Recent earnings by two builders, Lennar and KB Home, provided some additional insight into builders’ strategies for combatting the headwinds.

Lennar Beats Revenue Projections Thanks to Sales Incentives

Lennar, the second biggest homebuilder in the nation by revenue behind D.R. Horton, beat quarterly revenue expectations, rising 9% to $8.77 billion. This positive news was driven by an increase in home deliveries and new orders, supported by sales incentives directly aimed at the consumer.

“Although affordability continued to be tested by interest rate movements and simultaneously challenged consumer sentiment, purchasers remained responsive to increased sales incentives,” Lennar Executive Chairman and Co-CEO Stuart Miller said in the company’s earnings statement.

Part of Lennar’s sales incentives related to price reductions. The homebuilder cut the average price per home to $426,000 in the second quarter of 2024. Miller also highlighted the company’s focus on building affordable housing and strategic markets that help them fill the “chronic supply shortage.”

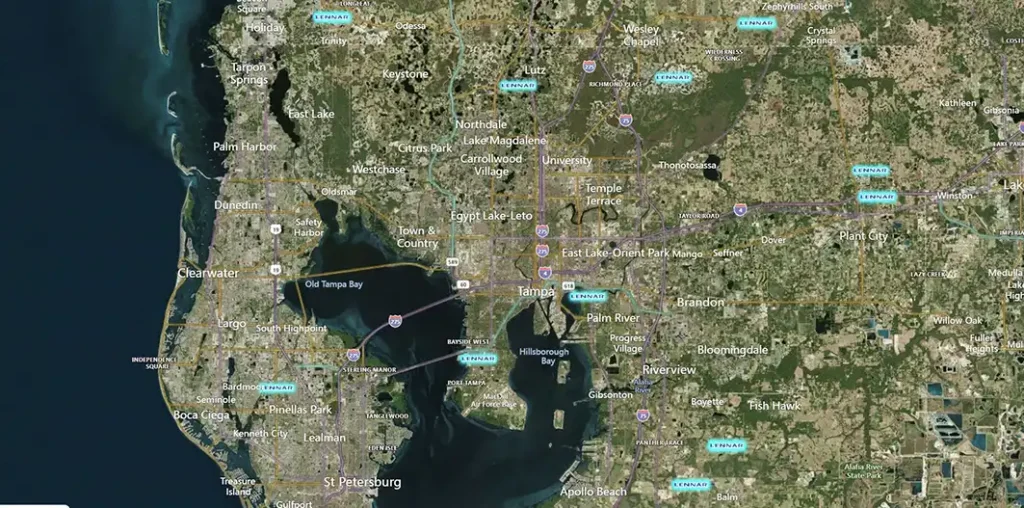

Lennar operates in 26 states across the country with more than 50% of their active sites in the Sunbelt states of Florida (20%), Texas (18%), and California (13%), according to LightBox Vision.

KB Home Outperforms Expectations with Critical Markers Up

KB Home, another of the nation’s top homebuilders, also outpaced Wall Street forecasts for its second quarter earnings. While the company’s revenue of $1.71 billion beat expectations of $1.65 billion. The homebuilder also reported that home orders rose 2% to 3,997, with order value growing 7% to $2.03 billion.

Several factors contributed to their positive news, including an increase in the average selling price per home and the monthly net orders per community. They reported that their average selling price rose to $483,000 up from $479,500, boosting their net order value by 7% and resulting in a 2% increase in net income. Additionally, the homebuilder’s net new orders per community were also up to 5.5 from 5.2 in 2023.

“Our pace of monthly net orders per community was one of our highest second quarter levels in many years, which we believe reflected the compelling personalized choice that our Built to Order model offers to meet each buyer’s lifestyle and budget,” KB Home Chief Executive Jeffrey Mezger said.

KB Home’s portfolio spans 47 markets across the country, with over 70% of its active presence in California (30%), Texas (25%), and Florida (16%), according to LightBox data.

While the company faces potential challenges like increased resale inventory in certain markets along with the headwinds of high construction costs and the higher for longer mortgage rates, it has over $3 billion in backlog, signaling strong future sales. The homebuilder continues to aim for growth, with plans to reduce build times to a range of four to five months, according to the company’s Q&A following their earnings release.

Strong Demand and Projected Rate Cuts Set Stage for Builder Growth

While 2023 was the strongest year for U.S. home completions since 2007, the 1.4 million additional homes were not enough to “make a meaningful dent in the nation’s existing housing shortage,” due to the demand. This deficit stems from years of underbuilding, combined with surging demand and a lack of affordable housing options. According to the NAHB, there is currently a 4.4-month supply of both new and existing homes for sale. A six-month supply reflects a balanced market between the buyer and seller. Notably, of the inventory currently on the market, new construction now makes up 30% of total inventory, about twice its historical share, according to the NAHB.

With market participants increasingly convinced that the Federal Reserve will begin cutting interest rates starting in September, prospective homebuyers will likely move from the sidelines further driving housing demand. As a result, the six-month sales expectation for builders has moved higher, according to the NAHB forecast. Analysts expect that low housing inventory, the ongoing demand for homeownership, and future rate cuts are expected to continue to fuel growth in the homebuilding market.