This three-part series explores how the environmental consulting industry is adapting its practices following the ASTM E1527-21 update and the recent classification of PFAS as a hazardous substance under CERCLA by the U.S. EPA earlier this year. Each part examines the results of the LightBox 2024 Benchmark Survey which focused on specific operational shifts that firms are making to meet new industry standards and support clients in managing PFAS risk.

As the environmental consulting industry continues to respond to the latest revisions that ASTM made to the E1527-21 standard and the U.S. EPA’s classification of PFAS as a hazardous substance under CERCLA, firms are grappling with increased operational complexities. This second installment of our three-part series explores the key findings from the LightBox 2024 Benchmark Survey, highlighting how the industry is incorporating PFAS risk assessments into their Phase I ESAs (environmental site assessments).

Client Perspectives and Industry Adoption

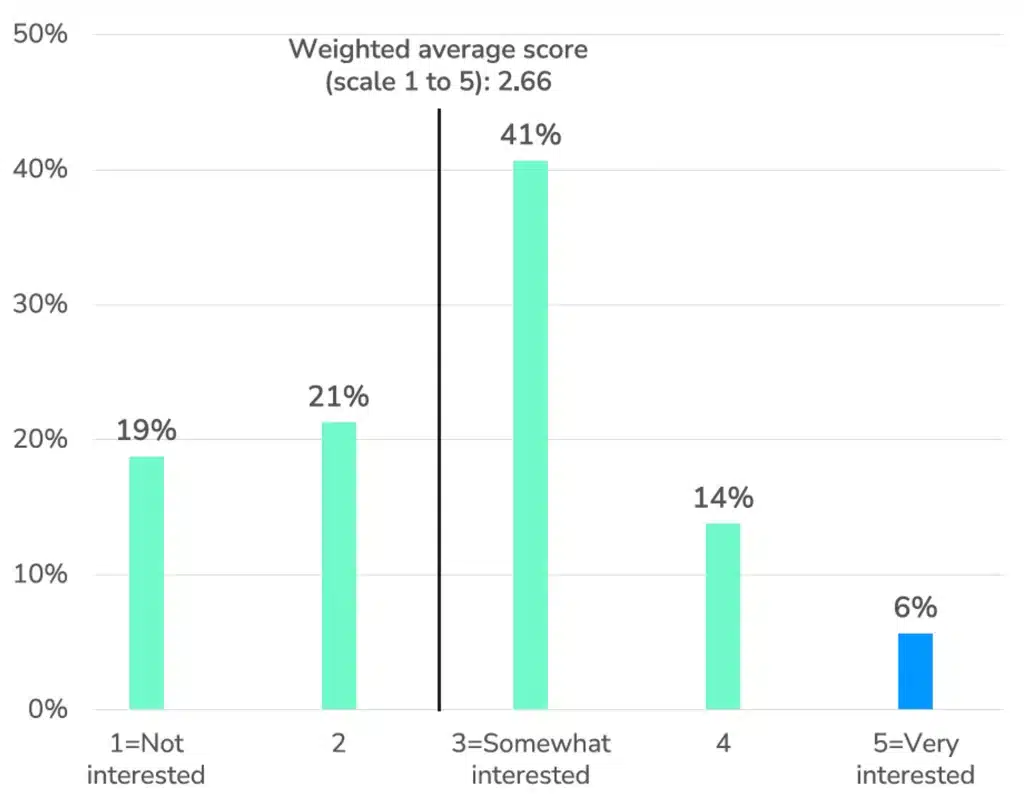

In terms of client interest in PFAS risk assessments, the survey responses from environmental professionals (EPs) were a nearly perfect bell curve, with the majority (or 41%) characterizing their clients as “somewhat interested.” On a scale from 1 (not interested) to 5 (very interested), responses averaged 2.66. The wide range of responses highlights the disparity in awareness and urgency regarding PFAS risks within the commercial real estate (CRE) sector. This variation reflects an industry still grappling with the science and regulations around PFAS. As understanding deepens and regulators align with emerging research, this gap will likely narrow. For now, some clients remain highly risk-averse, while others lack the awareness to recognize PFAS as a concern.

On the LightBox Environmental Due Diligence podcast Victor DeTroy, national practice leader of Due Diligence Services at AEI Consultants, “Lenders who have encountered costly PFAS-related issues are generally more proactive, while smaller investors often perceive it as less of a risk until they face a challenge.”

In general, how would you characterize your clients’ level of interest in assessing PFAS risk?

Jon Kitchen, Principal at Civil & Environmental Consultants, Inc., pointed out that many clients engage in PFAS assessments only because they are required to. “Perception of risk varies greatly,” Kitchen noted. Factors such as state regulations, business type, and proximity to drinking water areas significantly influence how risks are assessed. “Environmental professionals play a key role in educating clients about the scope of PFAS risks,” he added.

However, a gap in client education remains, as many investors lack a clear understanding of the implications. Smaller lenders and investors, who may lack exposure to such situations, often remain skeptical about the need for detailed assessments. DeTroy added, “For many, the idea of longer turnaround times and higher costs for Phase II assessments can be a hard sell.”

Georgie Nugent, environmental division director at McFarland Johnson, observed a different trend. “In the aviation sector, where property transactions often involve new tenants or due diligence, there’s a higher level of concern. Tenants want to know baseline conditions, especially if firefighting foam containing PFAS has been used,” she said. This sector’s proactive stance underscores the varying levels of urgency tied to specific industries.

Survey data further illustrates this divide. One respondent noted, “Clients involved in acquisitions are much more concerned with PFAS risk than those involved in refinancing.” Another added, “Many clients remain concerned about identifying a PFAS risk, yet they don’t know what steps to take if it’s found.”

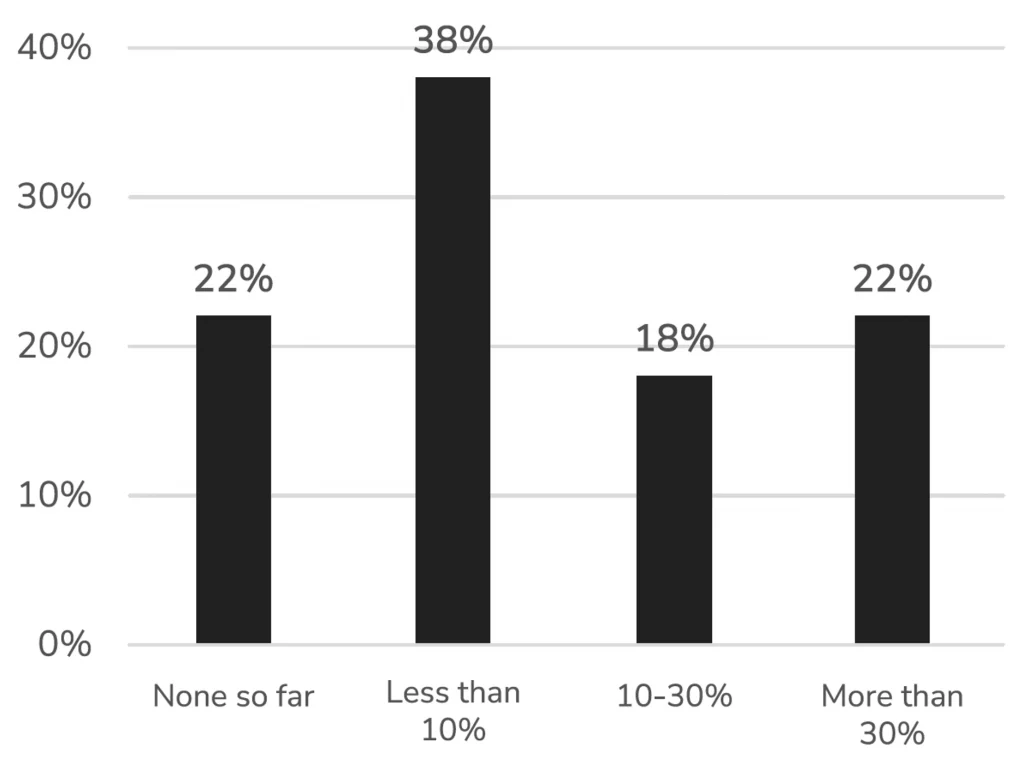

Our survey asked if EPs routinely include PFAS in the scope of their ESAs and while not intended as a trick question, it was designed to prompt reflection on whether PFAS is consistently considered alongside other contaminants. Nearly 70% reported that PFAS is included in their scope in some capacity, indicating that most are actively considering it. The survey also asked respondents to estimate how many of their projects include PFAS if they don’t always include it in the scope of an ESA, underscoring both the limited availability of data and the growing recognition of PFAS as a concern. Nearly 40% of respondents include it in less than 10% of their Phase I ESA projects, while 22% include it in more than 30% of their Phase Is. This wide range suggests that the CRE industry is still coming up the learning curve and the incorporation of PFAS risk into Phase I ESAs is likely happening on a case-by-case basis.

What percentage of your ESA projects would you estimate include PFAS?

PFAS adoption trends also vary significantly by region and industry. In the Northeast, for example, where PFAS regulations are more proactive, Phase I ESAs are more likely to incorporate research and a discussion of PFAS risks than in states that don’t have PFAS regulations in place yet. Meanwhile, Phase I ESA projects involving sites with past uses associated with high PFAS risk, like airports, manufacturing facilities and others, are more likely to address PFAS risk than Phase Is on sites with less risky current/past uses.

What Types of PFAS Are Included?

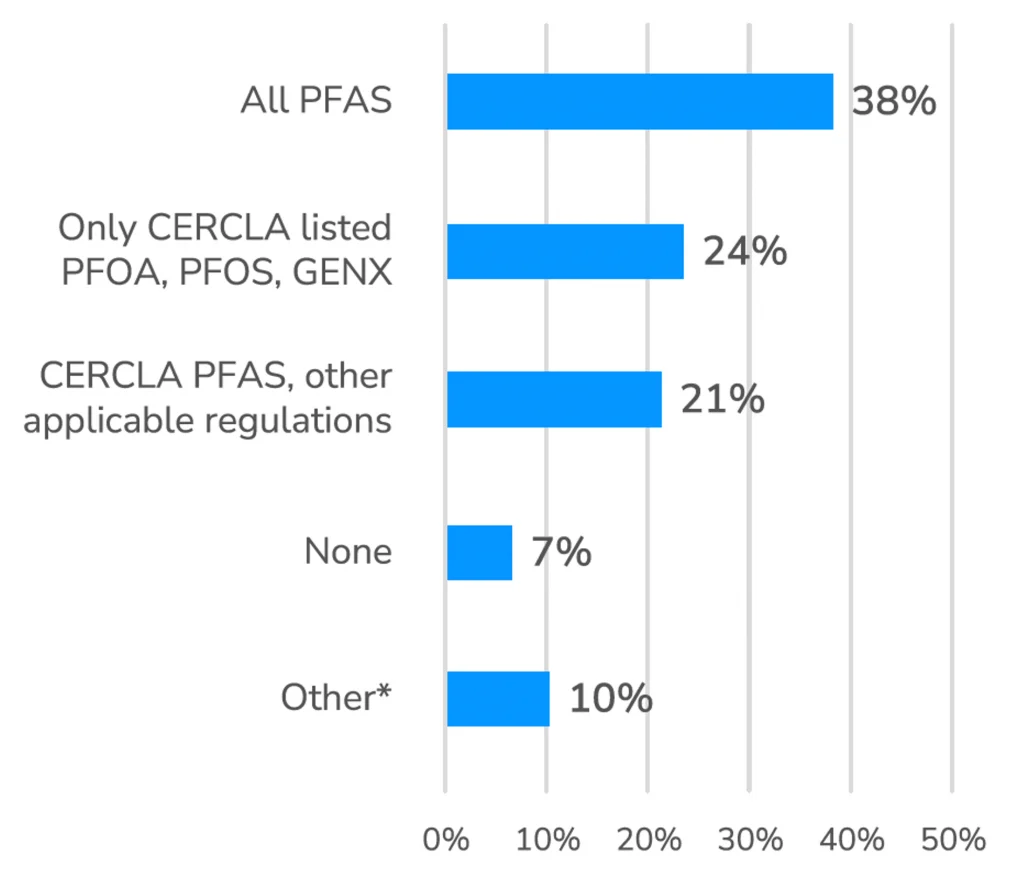

With thousands of known PFAS compounds, the industry is grappling with questions about scope, classification, and risk. Some EPs (38% of respondents) evaluate PFAS broadly, while others (24%) focus primarily on high-priority compounds like PFOA and PFOS. However, challenges arise with proprietary mixtures, such as AFFF (aqueous film-forming foam) used in aviation, where specific PFAS content is often undisclosed. This highlights the difficulties EPs face assessing PFAS as part of their standard environmental due diligence.

If you include PFAS in a Phase I ESA, what types do you include for consideration?

Regulatory frameworks vary by region, affecting how PFAS are classified in reports. Some professionals treat them as Recognized Environmental Conditions (RECs), while others classify them as BERs (Business Environmental Risks) especially when CERCLA liability is unlikely or unclear.

One respondent said: “We treat PFAS the same as other regulated contaminants.” Another respondent noted that it is rare that there is documentation of a specific PFAS compound, and they include all PFAS in their ESAs.

The Path Forward

The field of science behind understanding PFAS risk and efforts by federal and state regulators to assess risk exposure thresholds will only advance, and as it does, EPs will be challenged to educate and advise their clients on managing PFAS risk effectively. This emerging field is gaining attention rapidly, and as awareness grows, lenders and attorneys are likely to include it in standard environmental due diligence. Similar to other environmental risks, addressing PFAS proactively can help avoid costly surprises down the line.

In our next installment, we’ll explore PFAS risk reporting in depth, examining its impact on CRE deals and the strategies firms are using to navigate evolving regulations. Stay tuned for insights into how environmental consulting firms are adjusting their practices to reflect the growing awareness of PFAS risk to best serve their clients.