Manulife’s Dr. Victor Calanog “is expecting one or two rate cuts this calendar year,” cautioning that “nuance is required across property types, regions, and neighborhoods.”

On the main stage of PRISM 2024, two powerhouses provided attendees with an in-depth analysis of forces driving opportunities in the host city of Dallas, as well as the broader U.S. market. Dr. Victor Calanog focused on a comprehensive analysis of the latest cyclical and structural trends impacting the commercial real estate (CRE) market as a whole, while Torrey Littlejohn of JLL highlighted the market trends in Dallas, Texas, where the conference was held. The annual PRISM market keynote took on greater significance this year given the uncertainty of the Fed’s monetary policy and mixed signals from the market.

A Look Inside Dallas

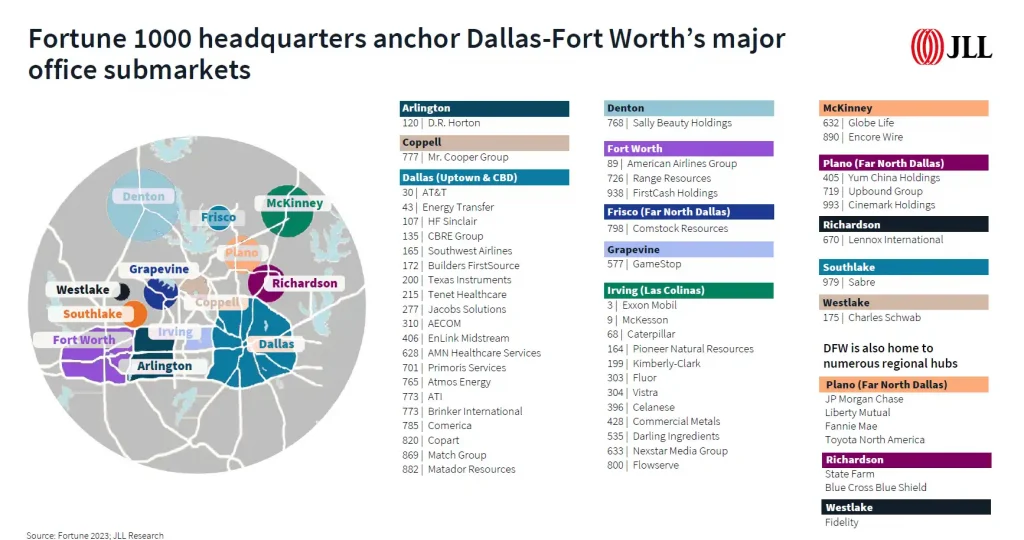

Well-known Dallas market expert, Torrey Littlejohn, Managing Director at JLL, kicked off the session by shedding light on the vibrant and rapidly growing Dallas-Fort Worth (DFW) metro area. With a population of 7.9 million and growing, DFW now ranks as the fourth-largest metro area in the U.S., after explosive 22% growth since 2011. “377 people per day are relocating to DFW,” Littlejohn noted. Attendees were abuzz over how many Fortune1000 headquarters like AT&T, Exxon Mobil and Caterpillar are anchored in the DFW office submarkets.

Littlejohn noted that keeping Dallas in investors’ crosshairs are “the extremely strong market fundamentals, a central location, low cost of living, high quality of life and a very diverse economy. Because of these factors, Dallas is experiencing above-average job and population growth relative to other metros and is therefore a magnet for real estate investment and development as well as more relocations of corporate headquarters.”

Employment in DFW grew by 3.2% year-over-year through 2023, leading the nation’s 12 largest markets, and even though the office sector is lagging compared to other segments —like it is across the country— the DFW office market does have some bright spots. “Dallas finished 2023 ranked second nationally for 10-year net absorption at 18.1 million square feet signed in the second quarter,” Littlejohn highlighted. This strong performance is further underscored by significant leasing activity and ongoing construction projects, such as the Goldman Sachs campus and Fields West, which are adding over one million square feet to the construction pipeline.

Geopolitical Concerns at an All-Time High

Transitioning to the broader CRE market, Dr. Victor Calanog, Managing Director & Global Co-Head of Research and Strategy at Manulife Investment Management, highlighted the mix of positive and negative factors impacting the investment and lending climate, and challenging an uncertain forecast. “This year, geopolitical issues are more prominent than ever, impacting global economic stability and the U.S. CRE sector,” he noted, highlighting the uncertainty and potential risks these factors pose. Global GDP forecasts, although resilient, are slowing with growth rates of 1.8-2% in major economies like the U.S. and China. This deceleration, if sustained, Calanog observed, can apply pressure to CRE markets, especially in areas that are heavily reliant on international trade and investment.

The Fed’s Rate Hike Pause and Its Implications

At its 2024 FOMC meetings, the Federal Reserve put any planned (and long anticipated) interest rate cuts on hold, leaving many to question what the rest of the year might bring. “In the fight against inflation, the Fed is likely done raising rates,” Dr. Calanog pointed out, referencing the last rate increase in July 2022. However, the Fed is proceeding very cautiously. Calanog predicts that “Two conditions need to be met for the Fed to feel more confident about lowering rates: unemployment needs to rise to 4.5% (currently, we are at 3.9%) and PCE [personal consumption expenditures] needs to trend at 2% or lower for at least three months.” The impact on the CRE sector as interest rates stay higher for longer is still uncertain, he remarked.

Sector-Specific Market Responses

An assessment of the state of CRE today, he noted, requires an important acknowledgement that different asset classes are responding variably to current trends. Retail has shown surprising resilience, while office properties are facing significant devaluation. “Any investors with office properties in their portfolios are marking them down by as much as 50%,” Dr. Calanog observed. On the other hand, the industrial sector continues to benefit from long-term tailwinds, indicating a more stable outlook for logistics and warehousing spaces.

In Dallas, Torrey Littlejohn highlighted how the local market mirrors these trends. “Leasing activity picked up in the second half of 2023, finishing the year with 10.7 million square feet of leases executed,” she said, underscoring the strong demand for commercial space in the region.

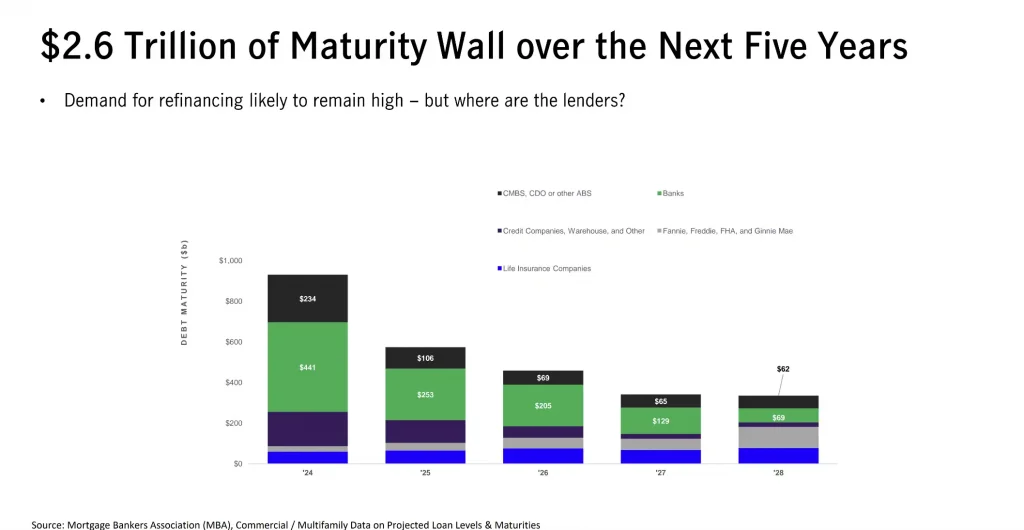

The $2.6 Trillion Maturity Wall

Dr. Calanog talked about the $2.6 trillion in loans maturing over the next five years and explained that one of the difficulties is that these loans are entering a higher interest rate environment, complicating refinancing efforts. “The demand for refinancing is likely to be high, and the question is: who will be the lenders stepping up to meet this demand?” Dr. Calanog asked. The first quarter of 2024 showed signs of recovery in certain lending sectors, with CMBS volume up significantly, he explained. Although the MBA’s forecast of a 29% increase in lending was based on the Fed lowering rates by mid-year, it’s their latest forecast and it calls for 2024 bringing us back to 2016-17 levels which Dr. Calanog observed “seems reasonable to me.” However, lending by banks and government-sponsored entities (GSEs) has pulled back, making the overall lending landscape still flat year-over-year.

Delinquency Rates and Market Complexities

While delinquency rates remain relatively low, there are also complex trends within specific property types. Office property delinquencies are rising, as are those collateralized by malls. This requires a detailed approach to investment decisions and risk assessment. “Uncertainty with the timing of when rates will come down is the reason the market is thawing very slowly,” Dr. Calanog explained, suggesting that the anticipation of lower rates might be delaying necessary market adjustments.

Green Shoots Ahead

The insights from Dr. Calanog and Littlejohn provide a comprehensive roadmap for navigating the CRE market’s current challenges. From the vibrant growth and strong economic performance of metros like Dallas to the broader geopolitical tensions and interest rate uncertainties, understanding these dynamics is essential for making informed investment decisions. As Dr. Calanog emphasized, “The variance in expectations for when interest rate cuts will happen is a big reason why commercial real estate transaction activity remains muted,” observed Calanog. “I’m still forecasting one or two rate cuts this calendar year. Until then, nuance is required across property types, regions, and neighborhoods. Conversations, collaboration, and coordination will be critical. Investors need to remember there are opportunities, but also risks that require discipline to assess appropriately before making decisions.”