Phase I environmental site assessments (ESA) are routinely conducted as part of standard due diligence before commercial real estate (CRE) deals close. The output of LightBox EDR’s ScoreKeeper model, which estimates Phase I ESA market activity on a metro level, sheds light on the cities that are attracting early interest from investors at this early stage of market recovery. During the market high of 2021 and early 2022, LightBox ScoreKeeper data tracked the migration away from high-priced and uber-competitive primary metros like New York, Los Angeles, and Chicago and into smaller metros like Nashville, Austin, and Charlotte. Today, more than four years since the onset of COVID, the market is poised to reinvigorate dealmaking as the Fed begins an interest rate reduction phase.

A recent analysis of ScoreKeeper’s metro-level data reveals how the largest markets for Phase I ESAs are faring, as well as smaller primary and secondary metros that are outperforming the industry benchmark. Recent shifts in demand could be early signs of broader trends in CRE as indicators of where investors are focused both in the top-tier markets and in others that might not have received much attention previously.

The Top 10 Metros

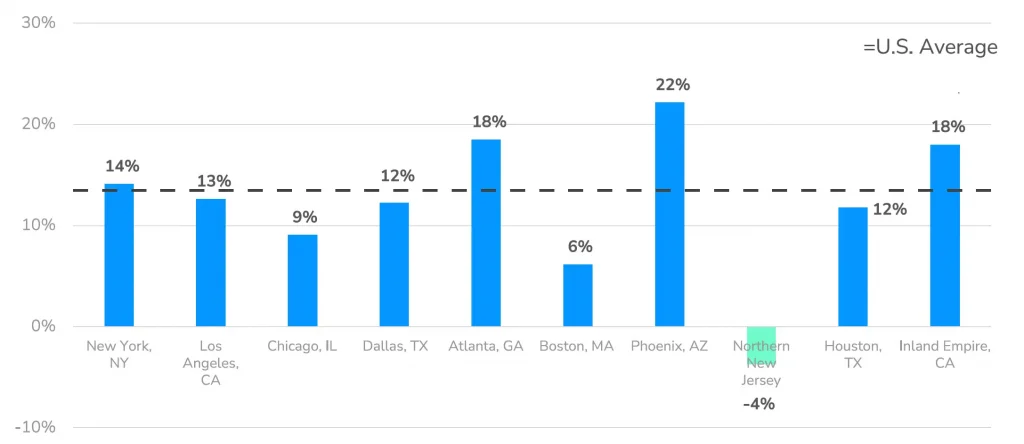

The graph below compares the Q2 vs. Q12024 Phase I ESA growth rates in the 10 largest markets to the U.S. industry growth benchmark (13%). Four of the ten leaders outperformed the industry average led by Phoenix with an impressive 22% quarter-over-quarter growth, followed by Atlanta (18%), Inland Empire (18%), and NYC (14%). Phoenix and Atlanta are both top markets for apartment construction and rising rents driven by strong population growth and higher earning migration. Phoenix is also a magnet for industrial property investment and data center construction.

10 Largest U.S. Markets for Phase I ESA Q2 2024 vs. Q1 2024

SOURCE: LightBox EDR ScoreKeeper model

Denver, Miami, and Pittsburgh Drive Strongest Growth

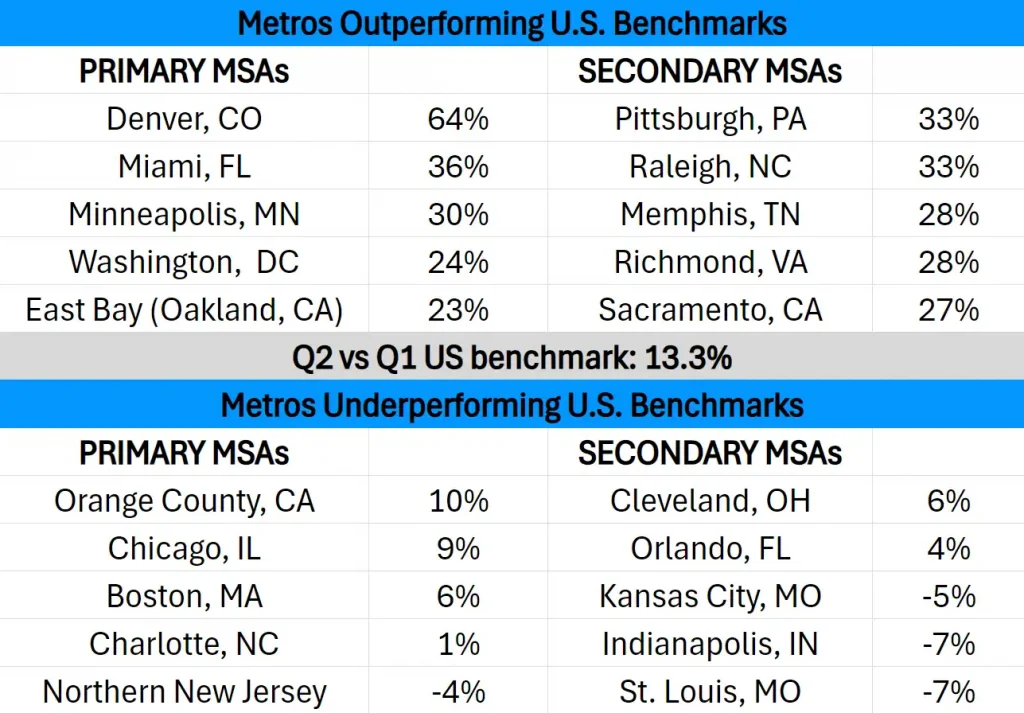

Outside of the largest Phase I ESA markets, however, lies perhaps an even more interesting story. Smaller primary and secondary metros experienced much more significant quarter-over-quarter growth, with Denver leading the pack at a staggering 64%. Rounding out the top three were Miami (36%) and Pittsburgh (33%). While smaller, these metros are experiencing a surge in Phase I ESA demand, an early sign of interest from investors shopping around for the best returns on their investment. Today’s trends are partly reflective of the migration from big cities like NYC and San Francisco to less expensive metros like Raleigh, Denver, and Nashville during the COVID pandemic.

“As the CRE engine begins to heat up for the first time in two years, investors and developers are increasingly looking beyond the usual suspects, seeking opportunities in markets that offer growth potential and perhaps more favorable conditions for new projects,” said Dianne Crocker, research director at LightBox.

The CRE industry is heterogeneous and each metro in the accompanying table has its own characteristics driving investment and development activity. “I wasn’t surprised to see Denver at the top of the list,” noted Crocker. “That metro is getting a lot of attention, but particularly for the office-to-housing conversions that we have been talking about on the LightBox CRE Weekly Digest podcast. Denver is also a heavy industrial market which is also driving significant interest.”

A Shift in Market Focus

The rise of these secondary markets as CRE hotspots marks a significant shift in the industry’s landscape. As Phase I ESA activity continues to grow in these regions, it’s clear that the future of CRE is becoming more geographically diverse. Investors and developers should take note of these trends, as they could represent new avenues for growth and opportunity in the coming years.

The LightBox monthly and quarterly reports will continue to shed light on these developments, helping industry professionals navigate the evolving CRE terrain.