In the first quarter of 2024, commercial appraisal volume from lenders increased 8.1% over the typical seasonal slowdown of Q4 2023 but remained 6.4% below last year’s first quarter. Despite the hopeful New Year’s forecast that a wave of loan maturities and the start of rate cuts by the Fed would trigger a rebound in demand, an analysis of data from LightBox analysis confirmed that despite moderate quarterly fluctuations, appraisal velocity is stable and well below 2021 and early 2022 volumes, and price and turnaround time pressures are intense as appraisers compete for projects in a challenging market. These results are consistent with the latest quarterly LightBox CRE Activity Index, which showed that activity increased quarter over quarter while still slightly weaker than one year ago.

The slow pace of new commercial real estate (CRE) loan originations is suppressing any meaningful rebound in demand for commercial appraisals as interest rates remain at high levels. While any substantial growth in demand for commercial appraisals is muted as lenders hold tight on the reins of borrowing, appraisers are supporting valuations for properties that are changing hands either by necessity or because the market is getting a sense that property price declines are moderating and the time to re-enter the market has arrived.

For appraisers eager to benchmark their own Q1 2024 activity against industry benchmarks, our latest CRE Market Snapshot for the appraisal segment highlights the latest trends and forecasts:

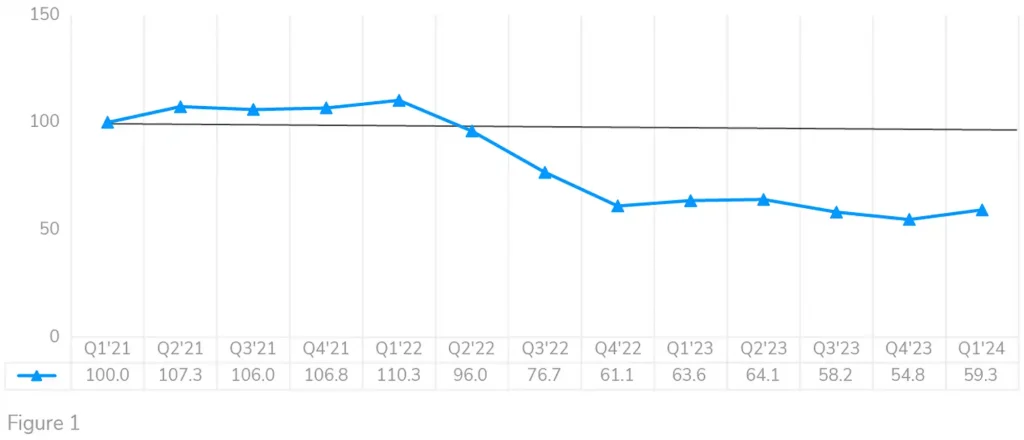

- The LightBox Appraisal Index started the year at 59.3 for Q1 2024, 4.3 points below Q1 2023’s 63.6 and 4.5 points above the previous quarter.

- Appraisal award volume (on a dollar basis) increased 8.7% QoQ but fell 6.7% YoY as the Fed’s Q1 stance of ‘higher for longer’ interest rates suppressed any notable uptick in lending volume.

- The average appraisal fee for the latest quarter was flat compared to the prior quarter, but down YoY due to the uber-competitive nature of the market.

- Pressure to compete based on turnaround time is intense with the average turnaround time in Q1 faster than the prior quarter and one year ago.

LightBox CRE Activity Index (Base Q1 2021=100)

Appraisal Index

Early Q2 Volume Looks Moderately Promising

Looking ahead, the LightBox Appraisal Index could see modest upticks in the remaining three quarters of the year based on positions announced over the past quarter by big investors like Blackstone and Goldman Sachs that they are ready to reinvigorate investment in U.S. commercial real estate.

The market will also start experiencing the impact of 2024 CRE loan maturities, as well as any 2023 maturities that were extended to this year, and the potential increase in demand associated with appraisals needed to generate updated valuations on the properties used as collateral for these loans.

April’s appraisal volume moderately increased by 3% compared to last April, but came in at 5% below March levels, bringing YTD volume for the first four months of 2024 to just 1% below the corresponding period of last year. If demand increases in May and June, Q2 could be the second consecutive quarter of growth in the appraisal segment, although that could be challenging given that high interest rates are here to stay at least for the next quarter and possibly longer.

The LightBox CRE Market Snapshot Series, Q1 2024 — Focus on Lender-Driven Appraisal Trends — presents data from more than 1,200 banks and credit unions across the United States and reflects industry benchmarks specific to lender-driven commercial property appraisal activity. The data are derived from LightBox applications Collateral360 and RIMS, which are used by financial institutions to manage and procure appraisals in support of property lending activity. The LightBox CRE Activity Index combines appraisal activity with environmental site assessments from LightBox EDR and property listings in LightBox RCM to create a composite of CRE transaction activity.

For more information about this report series or the data, email Insights@LightBoxRE.com