The early 2024 interest rate cut hinted at by the Fed at its meeting last December has yet to materialize. In fact, coming out of this week’s FOMC meeting, the Federal Reserve decided to hold rates steady given the modest easing in May’s CPI reading. Disappointing to anymore expecting multiple rates cuts this year, the Fed is forecasting just one mild quarter-point rate cut by year-end, down from the three cuts they were forecasting in March. Despite the lack of change on the interest rate front, the LightBox Monthly CRE Index demonstrated the third consecutive month of steady, albeit, moderate increases in activities that support dealmaking.

Two years after the Federal Reserve triggered its aggressive 2022 rate hikes, the commercial real estate (CRE) industry is eager for signs of a market pivot.

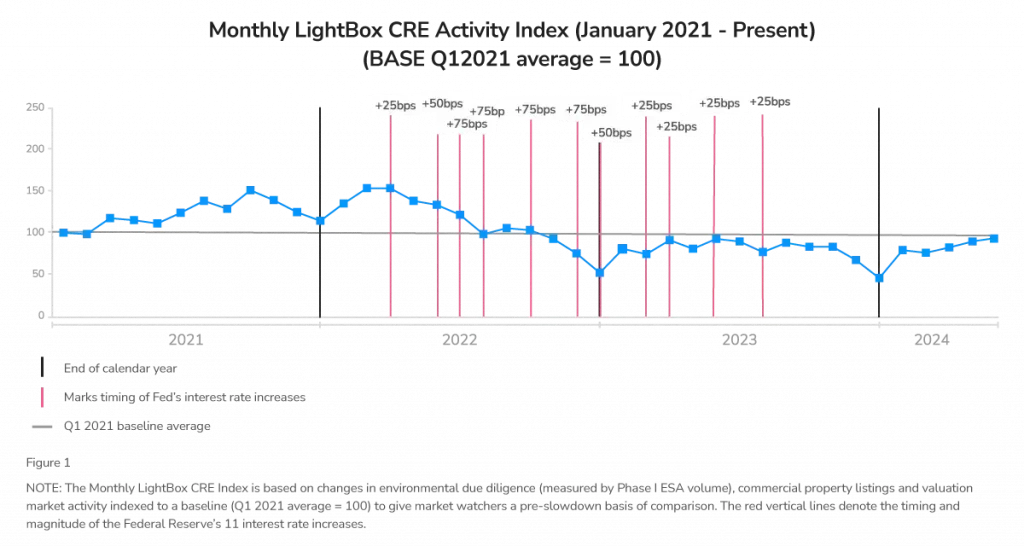

The early 2024 rate cut hinted at by the Fed at its meeting last December has yet to occur due to unconvincing inflation data. Yet, for the third consecutive month, the LightBox Monthly CRE Activity Index demonstrates steady, albeit moderate, increases in activities that support dealmaking. The Index is an aggregation of daily transactions over the LightBox network measuring changes in the velocity of listings, valuations, and environmental due diligence.

As a result, the LightBox CRE Activity Index tracks the movements in response to shifts triggered by changes in monetary policy, market conditions and other factors. In the past, market analysts have used public records and the Fed Flow of Funds (reported quarterly) to measure CRE activity. The LightBox Monthly CRE Activity Index captures data months ahead of public records filings and/or Federal Reserve data.

Modest May Uptick in Velocity

As noted, the latest data was the third consecutive month that the Index registered an increase in CRE activity, a particularly promising development coming so soon after the Index hit a three-year low of 45.7 in December 2023. The May 2024 LightBox CRE Activity Index came in at 91.1, an increase of 2% over April’s 89.5 level.

Notably, May 2024 numbers were the highest levels reached by the Index since the June 2023 reading. Although the May 2024 Index is slightly below last May’s 93.2, the current level is 14% higher than the 12-month moving average of 79.6.

Even Mix of Optimism and Caution

The CRE market is a function of market conditions as well as expectations. The latest improvements in the CRE Activity Index mirror the sentiment of market participants who are experiencing recent boosts in business activity across a broad range of CRE sectors.

Although reports of distressed asset transactions are largely limited to the troubled downtown office sector, the stronger Index report in May likely reflects a growing impatience by the market to place capital even in the absence of interest rate cuts.

Forecasting future activity will be challenging for the rest of the year, as participants weigh the likelihood of H2 Fed rate cuts and whether or not the Fed is successful in taming inflation.

A review of the LightBox CRE Index back to January 2021 illustrates the sensitivity of market activity to fluctuations in monetary policy. The aggressive interest rate hikes of mid-2022 (denoted by vertical red lines in Figure 1) were followed by a dramatic market decline by the end of the year. CRE activity continued to fall below the January-March 2021 baseline for all of 2023 as the Fed raised rates four more times.

Although reports of distressed asset transactions are largely limited to the troubled downtown office sector, the stronger Index report in May likely reflects a growing impatience by the market to place capital even in the absence of interest rate cuts.

“More and more, CRE professionals appear to have come to grips with higher interest and cap rates. While still nowhere close to the desired pace, sales activity is picking up; transparency is increasing; and buyers and sellers are coalescing around fair value. That even extends to the office space where transaction activity continues to increase—albeit at prices that often mean big losses for sellers.”

– Manus Clancy, LightBox Head of Data Strategy

The role that expectations play in turning points is critical, and the latest May CRE Activity Index provides data-based evidence that the slow start to 2024 could well be starting to slowly reverse itself.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. The Index report is also part of a series of the more detailed LightBox Quarterly CRE Market Snapshot Series reports. To receive LightBox reports, subscribe to Insights.