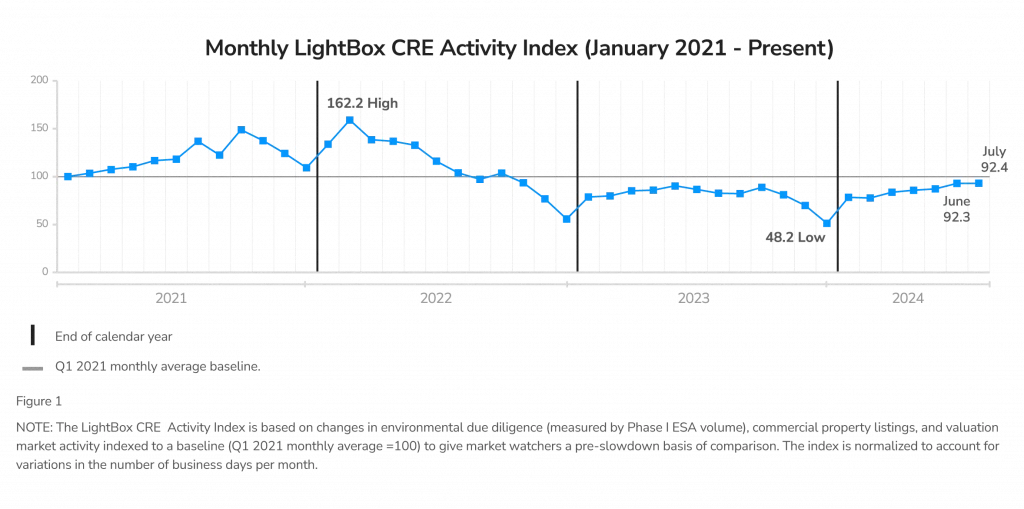

Turning the page to the second half of 2024, July delivered an unexpected round of volatility in the broader economy that did little to slow momentum in the commercial real estate (CRE) market. Against the backdrop of weaker-than-expected unemployment and jobs data, the Fed left the late July meeting—its fifth meeting of the year—with rates still unchanged. Despite the weak July jobs data fueling fears of an economic recession, the CRE market marched forward with little change in the LightBox CRE Activity Index, the industry’s cross-segment barometer of key functions supporting dealmaking. The Index, an aggregation of daily transactions over the LightBox network, measures shifts in the velocity of property listings, valuations, and environmental due diligence.

July Continues June’s Momentum, Market Looks Ahead to September Rate Cut

July’s aggregate index, coming in at 92.4 was little changed from June’s 92.3 reading. Compared to one year ago, however, the difference was more pronounced. July increased more than 10 points above last July’s index of 81.4. Driving July’s momentum were single-digit month-over-month increases in demand for the environmental due diligence and appraisal activity that is supporting the early round of dealmaking. Properties listed for sale in July declined modestly as is common with a mid-summer pause, but were notably 21% above the tepid volume of last July.

Market Volatility Does Little to Take Wind Out of CRE’s Sails

LightBox market metrics for July, as well as anecdotal evidence, support the position that the momentum that first took root in early 2024 continues to strengthen despite the latest disappointing data on job growth, unemployment, and wages. New CMBS issues and transactions continued, with lending spreads remaining stable. A decline in Treasury yields provided borrowers with favorable conditions, and the expectation of a September rate cut by the Fed is bolstering market confidence.

July also brought encouraging signs of more portfolios changing hands, a healthy influx of bidders on individual property listings, and a new round of sales across asset classes and geographies. An analysis of the LightBox data on nondisclosure agreements by asset class revealed that NDAs on listings in multifamily and retail are above the national average across all property types. As dealmaking builds steam, it brings more clarity to pricing and sends a powerful message to the market that prices aren’t likely to fall much further.

“We saw high volatility in the market in July, yet the CRE market continued to soldier on. Lenders are lending. Sales are taking place,” observed Manus Clancy, LightBox Head of Data Strategy. “As we’ve discussed in our recent CRE Weekly Digest podcast, the market is looking past volatility to focus on closing the deals that make sense. The silver lining for the CRE market is that falling Treasury yields should support strong asset prices.”

Strong Start to H2 2024 As Clarity Slowly Emerges

The ability of CRE to exhibit the resilience it showed in July amid a disappointing round of market indicators and significant uncertainty is encouraging for the near-term forecast, although the market is not out of the woods yet. Five months of steady increases in the LightBox CRE Activity Index are fueling cautious optimism. Whether August and September continue the trend remains to be seen, but “if cap rates compress,” Clancy predicted, “we’ll see a real uptick in activity in the coming months because investors will not want to be left behind.”

With a growing volume of opportunities and liquidity slowly returning, the story of the second half of 2024 becomes one of opportunity and how fast and how aggressively those with capital will pursue investments. In several areas, market activity doesn’t reflect the news narrative. For instance, despite rising national office vacancies, companies are inking deals and leases to move their headquarters into growing population centers, and even expand their footprint, bucking national trends. Retail vacancies are at 20-year lows and assets continue to attract healthy interest in a supply-constrained asset class, particularly grocery-anchored suburban shopping centers. Industrial interest remains strong especially for distribution warehouses, data centers, and cold storage.

In the second half, investors will be challenged to balance the current volatility and uncertainty against a growing universe of viable investment opportunities, particularly for redeveloping older properties into more desirable uses with the amenities that today’s tenants are demanding. CRE appears to be at an inflection point, but plenty of challenges lie ahead. The labor market has been consistently strong this year, but recent data on job growth and unemployment are concerning, especially for the already-challenged office sector. On the dealmaking front, the CRE market is poised to respond to growing pockets of opportunity across geographies and property asset classes.

The forecast from LightBox for the next two quarters reflects a market that is only in the early stages of unraveling distress. It highlights a growing willingness among major investors to deploy capital early and a heightened focus on property valuations. However, the market faces headwinds from geopolitical uncertainties, concerns about a weakening jobs market, and the uncertain timing of future rate cuts.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.