After a strong start to the year, the second quarter saw a change in sentiment across commercial real estate lending amid confusing economic barometers. The market is adjusting to inflation and the first increases in interest rates from the Fed in decades. There is no shortage of capital looking for a home in U.S. commercial real estate, and property fundamentals are still largely positive. Because of recent headwinds, forecasters lowered previously rosy expectations for this calendar year. Activity across LightBox’s platforms in the environmental due diligence, valuation, lending, and investment sectors reveals some early trends. Below are my views on five of them and their impact on shifting near-term expectations for the second half of 2022.

No. 1: A Tale of Two “I’s”: Inflation and Interest Rates

Inflation and interest rates are key drivers in 2022. The Ukraine conflict has added to rising inflation, which is increasing at its fastest rate in 40 years. The question is whether the Fed can effectively reduce it without triggering a recession. The market can expect steadily rising interest rates for the foreseeable future, and the three increases so far this year are already being felt. Residential mortgage demand sank to its lowest level in two decades because of high inflation and rising interest rates.

The latest data from LightBox’s RCM® broker/investor platform reveal that higher borrowing costs are already shrinking the pool of buyers, with some shut out of the market. Lenders face a sense of urgency into the originations process as borrowers look to lock in rates before future increases take hold. However, real estate is largely viewed as a hedge against inflation, and the outlook for investment in Europe raises the probability that capital flows into the U.S. will increase. Nonetheless, it is likely that commercial real estate originations for the year will be lower than originally forecast in response to the changing dynamics in lending costs.

No. 2: Higher Interest Rates Pressure Lender Underwriting

There was a record flow of debt capital to U.S. commercial real estate investments in 2021, and the universe of lenders had largely returned to pre-pandemic conditions. An unexpected uptick in the delinquency rate is worth watching, as are commercial property lending levels, which were up by 72 percent in the first quarter compared to the same period last year.

LightBox clients say that borrowers are rushing to lock in low rates, adding urgency in a fast-paced market, pressuring commercial real estate lenders and the vendors they work with to complete environmental due diligence, appraisals and other underwriting before the rate lock expires. Some banks are pulling back their expectations or even shuttering new originations for the time being.

As rising interest rates increase the cost of capital, they are exerting downward pressure on property prices. A growing number of investors are expecting a market correction by the third or fourth quarter simply because property prices can’t keep rising. There is more scrutiny in underwriting, including more of a focus on operating costs, revenue forecasts, and future pricing assumptions. The fact that real estate is largely viewed as a hedge against inflation is a positive, but with capital getting more expensive, some borrowers will drop out.

No. 3: Second Quarter Data Reflects a Cooling Investment Climate and a Shift to a Buyers’ Market

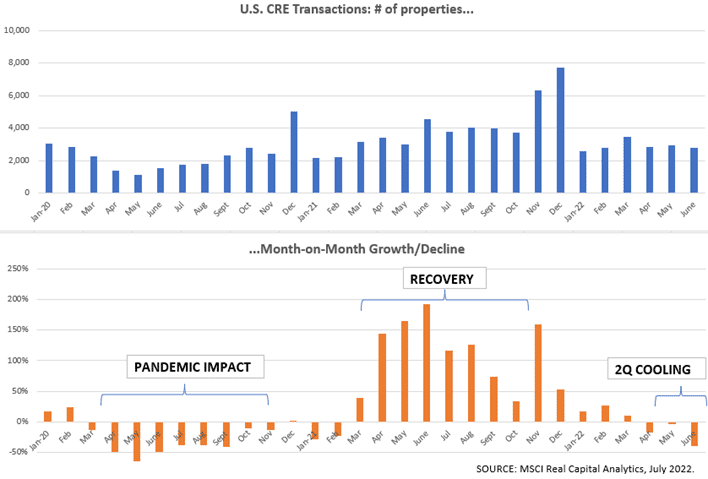

Commercial property investment activity is responding to changes in market dynamics after record-setting deal-making volume in 2021 that continued through the first quarter. By the end of March, commercial property sales had climbed at double-digit rates from a year prior despite uncertainty. Individual asset sales grew in the first quarter.

Deal activity was dominated by institutional equity deals that were less sensitive to higher borrowing costs than smaller deals where leverage is more critical. Growth rates are normalizing to more traditional levels compared to the double-digit recovery rates experienced immediately following the pandemic.

Market barometers from LightBox’s RCM® platform reveal several recent trends. The number of listings coming onto market continued to rise through the end of April, but the buyer pool is thinning, suggesting a market with more emphasis on selling. Growing uncertainty may be spurring sellers to list properties now rather than wait for better market conditions. With interest rate increases ahead, there could be an urgency to close deals in the third quarter. Given the high levels of capital and still-healthy property fundamentals, the trajectory of the commercial property market over the near term is still largely positive, just not as strong as it was in 2021.

No. 4: Secondary Metros and Technology Hubs Are Driving Growth

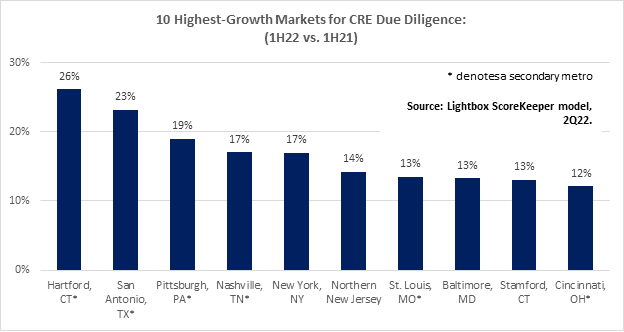

The latest data from the LightBox ScoreKeeper model—which tracks trends in the volume of environmental due diligence across the U.S.—shows continued strength and investor interest in commercial properties in smaller, secondary markets. The model’s output is widely viewed as an early indicator of where commercial real estate investment activity is increasing or losing steam.

Growth in property due diligence activity is above industry benchmarks in secondary metros. The accompanying graph shows an analysis of Phase I ESA activity in the first half of 2022 versus the corresponding period last year in the 50 largest commercial real estate markets of the U.S. The 10 cities highlighted in the graph outperformed the average five percent growth in due diligence activity across the top 50 metros. Interestingly, six of the ten are secondary markets. The New York City metro area, northern New Jersey, and Stamford, Connecticut, are rebounding strongly.

No. 5: Forecasts for the Second Half Are Being Downgraded Because of Growing Risks

Changing market conditions in the second quarter are prompting some market observers to dial back earlier 2022 forecasts. It’s not surprising that commercial real estate lenders and investors are cautious. If market volatility continues or worsens, sellers could take a wait-and-see approach until rates and uncertainty stabilize. As borrowing costs increase, investors will seek lower prices. Given how aggressively many asset classes have been priced in recent quarters, a market correction is widely expected later this year, particularly with in-demand properties like multifamily and industrial.

Lenders must exercise caution in their underwriting and make sure their assumptions about property expenses, rent growth, and other market conditions are reasonable. Faced with a possible recession, the industry is exercising caution, lower risk tolerance, and an urgency to close deals. For the second half of 2022, persistent economic and political uncertainty seem likely to continue. Environmental consultants, appraisers, and property condition assessment providers face pressure to complete their assessments quickly and accurately, given the growing reliance on interest rate locks. Important forces to watch are the pace of property deals, the timing and magnitude of rate increases, and a flattening of the property pricing curve. Underwriting assumptions should be tested under various scenarios to ensure prudent decision-making appropriate for today’s uncertain climate.