With the second half of 2024 underway, the commercial real estate (CRE) market is navigating some choppy seas with a mix of barometers across metros and asset classes. However, a raft of fresh data has taken near-term market sentiment from fears of recession to continued resilience and recovery. And, despite lingering concerns about consumers pulling back on spending and distress in multifamily loans, retail and multifamily properties remain bright spots for investors.

As early movers begin to wade back into the water and close transactions, it will bring clarity to the pricing haze that complicated deals in late 2022 and 2023.

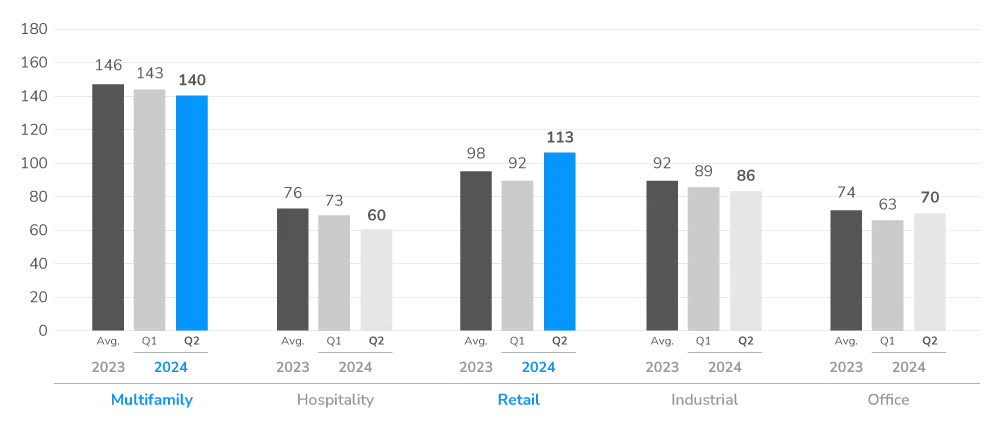

As highlighted in the LightBox Q2 2024 CRE Market Snapshot, investor interest in the multifamily and retail sectors outpaced the national average, as measured by the average number of non-disclosure agreements (NDAs) per listing in the LightBox RCM platform. Multifamily and retail are both undergoing a post-COVID recalibration to new market conditions, and the recent NDA data from LightBox validates that investors with capital have these sectors in their crosshairs.

Retail: A Story of Resilience and Evolution

One of the standout performers in today’s market is the retail sector, which has been a surprise to the upside after pre-COVID predictions that e-commerce would deal a blow to brick-and-mortar stores. Instead, COVID triggered hybrid work models and fueled greater demand for grocery stores, gyms and fast food, especially in strong suburban markets. The strongest e-commerce retailers also pivoted to open stores for customers to experience their products first-hand and obsolete malls are getting repurposed into alternative mixed- use developments. In response, and to the surprise of many, retail store openings outpaced store closures this year for the first time since 2016, and vacancy rates are at or near 20-year lows for strip malls and neighborhood shopping centers. Major store closures announced by big retailers like Macy’s, Bed Bath & Beyond and others like Walgreens and Big Lots are being met with healthy demand from new buyers eager to open stores in metros with strong population growth.

In a trend first observed by LightBox General Manager Tina Lichens in early 2023, retail is seeing renewed interest by investors despite the once-dire forecasts. Retail commercial property listings volume in the LightBox RCM platform increased in the second quarter by a strong 19% and 21% year over year, second only to industrial with listings up 34% Quarter over Quarter. Just a few years ago, the number of NDAs files for a retail asset was in the range of 70-80, but in Q2, it rose to 113, a significant jump from its 2023 average of 98 and well above the Q2 average of 105 across all asset classes. This surge in activity is driven by strong consumer spending and limited new supply, resulting in historic low vacancies. Stores vacated due to bankruptcies and closures by big box retailers are quickly being filled by other retailers aiming to expand and adapt to changing market dynamics and consumer behavior.

Retail Gains More Interest from Investors: Retail saw substantial growth in transaction volume, as well as investor interest, with listings volume up nearly 19% quarter over quarter and 21% year over year. (Average NDAs of 113 in Q2 2024 marked a historic high since 2022).

Multifamily Market Adjusts to New Realities

In the multifamily sector, properties listed for sale in the second quarter accounted for 32% of the total, more than any other asset class and well above industrial in second place with 17%. Notably, multifamily listings increased by a solid 19% increase over the first quarter with some notable deals closing in Q2, including a $2.1 billion deal by KKR for a portfolio of 18 Class A apartment complexes with more than 5,200 units across the U.S. and a sale by JP Morgan Asset Management for an apartment complex that sold for 12% above its 2018 purchase price. More than half a million apartments are expected to be completed this year, an increase of 9% over 2023 and 30% from 2022, but the majority are high-end developments. High borrowing costs and economic uncertainty are forcing other developers to rethink construction and pivot to projects in lower-risk markets. Falling rents in some metros and a decrease in construction starts are setting the stage for potential rent acceleration, particularly in areas with strong labor markets. The continued housing shortage and rising home prices continue to favor investment in multifamily, although concerns are rising about distressed assets as floating-rate loans originated in a lower interest rate environment mature.

The average number of NDAs executed per property listing on the LightBox RCM platform for multifamily was 140 in Q2, slightly lower than the 2023 average of 146 and well above the aggregate 105 across all asset classes.

Asset Classes with Highest Investor Engagement Based on Average Volume of NDAs Executed in LightBox RCM (2023-2024)

Investor Confidence in Multifamily and Retail

The capital markets and investment trends within commercial property listings for multifamily and retail sectors reflect that more assets are moving into play and that potential investors are taking notice. If Q3 brings the first interest rate cut, these data points will likely see an increase, especially as buyers get more active in scoping out investment opportunities. As more deals close, some at appreciated values relative to the previous sale, investors in retail and multifamily will get the sense that the window of opportunity is open.

For a more in-depth analysis and insights focused on capital markets and investment trends, check out the LightBox Q2 2024 CRE Market Snapshot.