As the market looks for reassuring signs that the commercial real estate (CRE) market has hit bottom and is positioned for recovery, the work of appraisers is front and center. Investors, in anticipation of falling rates, are scoping out the strongest opportunities. Lenders are dealing with a growing swell of CRE loan maturities and assessing their portfolios for signs of distressed loans. Owners are staying abreast of declining asset values as they evaluate whether it’s the right time to sell, and if so, for how much? Property values play an even more critical role in decision making in a market struggling to find its footing after the slowdown of the past few years. As a growing volume of assets and loans come under scrutiny, demand for appraisals will only gain steam. The LightBox Appraisals Index is an early indicator of how July and August lender-driven appraisal volume is shaping up relative to midyear metrics as well as activity one year ago.

Appraisal Activity at Midyear

As reported in the latest LightBox Q2 2024 CRE Market Snapshot, Q2 was the second consecutive quarter of increases in lender-driven appraisal volume after two quarters of decline in the second half of last year. Lenders’ appraisal volume grew 6.8% over the prior quarter and 4.9% year over year. Slightly stronger appraisal activity in the early part of Q2 drove the modest uptick, largely due to loan sales, refinances, and early work related to the unraveling distressed assets—including several high-profile transfers of downtown office buildings. Appraisal demand from lenders for new originations, however, is still constrained by high interest rates, and the slow transactions market is making property valuations more difficult as appraisers have fewer comparable transactions to reference although recent sales activity in the LightBox CRE Weekly Digest podcast is encouraging.

LightBox Appraisals Index Shows Early Q3 Strength

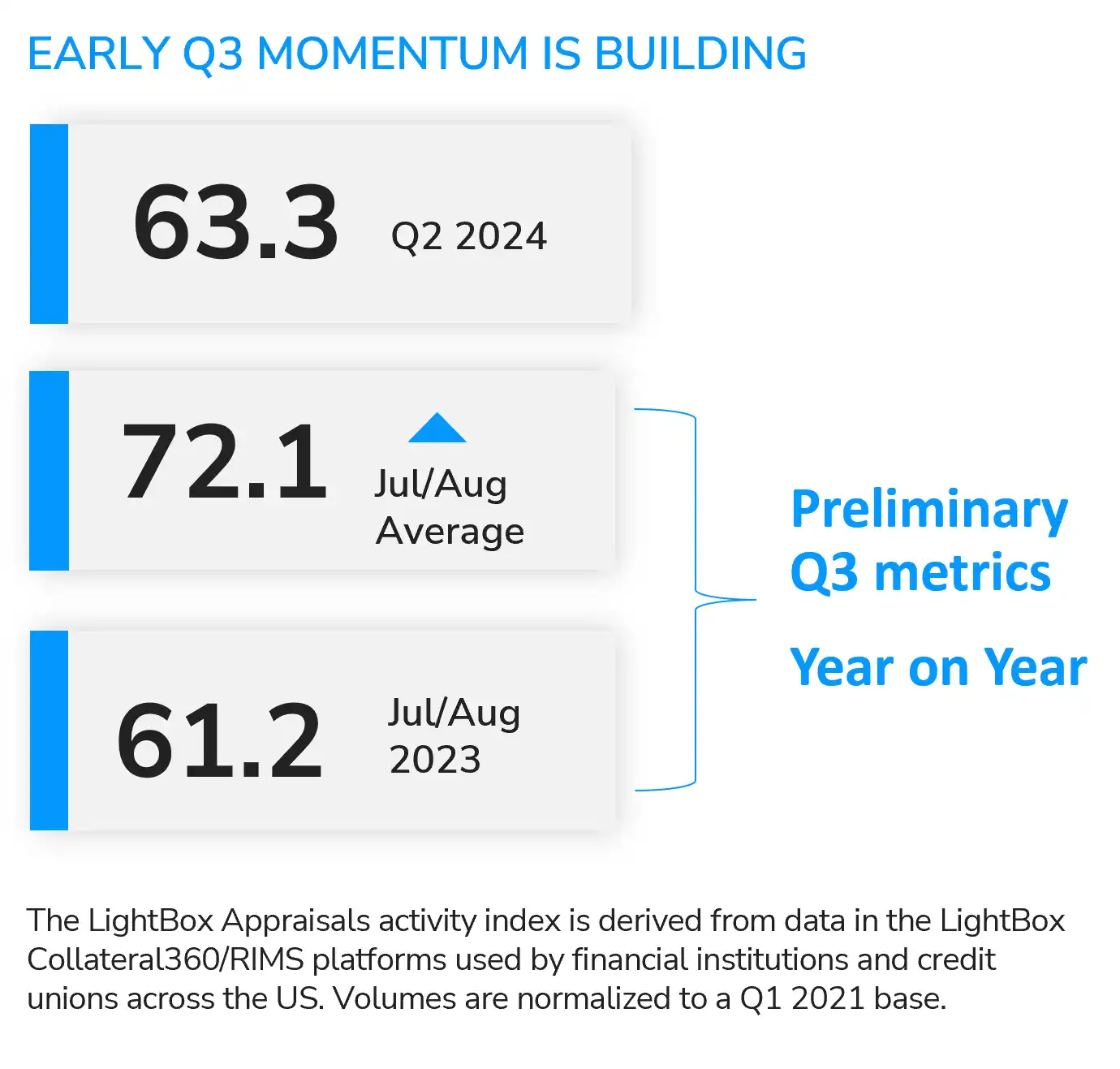

The LightBox Appraisals Index, a monitor of how lender-driven appraisal demand is changing relative to an early 2021 baseline, stood at 63.3 in Q2, an increase of 1.8 points above Q1 and just below 64.1 in Q2 2023. Based on the monthly July and August appraisal volume in the Collateral360/RIMS platforms used by thousands of lenders across the U.S., the Index for the first two months of Q3 increased to 72.1, a nearly 9-point increase over Q2. The uptick is particularly notable given that July and August are typically slower months as the summer season winds down. Compared to 2023, the increase was a more pronounced 10.9-point jump, signaling that the Index for the full Q3 may land well above the 57.9 of Q3 2023.

A Pivot Point for the Market?

2024 has been a year of pushing out projections of a Fed rate cut from March to June to July and now September. Even though rates have not yet moved, in many sectors of CRE, property prices are stabilizing, and values are increasing, signaling a significant pivot point for the market after the limbo of the past several years. For instance, certain industrial, retail, and multifamily assets, especially in metros where construction activity has slowed, are driving up demand for existing assets, and as a result, are being appraised at, and selling at, prices above prior values.

The interplay of factors that challenged CRE deals last year—the bid-ask gap between buyers and sellers, lack of price certainty, lower valuations, and financing challenges—are showing signs of modest improvements and the first Fed rate cut will only add momentum.

As noted by Jeff Garvin, Chief Appraiser at Bank OZK, in a panel at the LightBox PRISM conference in Dallas, “While Class B and low-A grade properties face challenges, recent transactions in stabilized properties are beginning to reset the market and there are billions in capital ready to invest once the conditions are right. Distress, on the other hand, will be a slow boil as the volume of loans in distress increases and needs to be dealt with.”

Although lender-driven appraisal activity will remain weak in the high-interest-rate environment, appraisers will continue to see demand from investors eager to place capital, as well as forced loan sales, divestitures, and an expected increase in distressed assets. As Q3 winds down, the market is poised for stronger appraisal activity in Q4 as the first interest rate cut is announced with others likely to follow.

Stay tuned for the next Appraisal Index reading and Snapshot Report in early October!

Keep up with the latest insights from Lightbox, and look out for the upcoming Appraisal Index Snapshot Report, releasing in early October.