Suzy Gardner of Trusted Advisors GAP Services moderating the LightBox PRISM 2024 panel on climate risk featuring Rich West from AEI Consultants, David Lambert from Wells Fargo, and Becci Curry from CBRE.

“Climate risk is now a business risk.”

The commercial real estate (CRE) industry is undergoing a seismic shift, driven not only by the aftershocks of the pandemic, unprecedented interest rate hikes and the associated CRE slowdown, but also the rising frequency of extreme weather events and a growing awareness of climate risk. This confluence of factors is challenging the CRE industry to grapple with how to holistically assess, mitigate and manage property risk in a way that effectively considers climate risk. Two issues making climate risk a priority for CRE businesses are: the rising cost of insurance and increased pressure on lenders to include climate risk in underwriting processes. At the recent LightBox PRISM 2024 conference, a multidisciplinary panel of experts discussed these complex issues, moderated by former FDIC regulator, Suzy Gardner of Trusted Advisors GAP Services. The panel also featured Rich West, Head of Valuation at AEI Consultants; David Lambert Executive Director, Head of REVS Environmental, Wells Fargo; and Becci Curry, Head of Quality & Risk Management, Americas, CBRE Valuation and Advisory Services.

Climate Risk: A Core Business Issue

One of the primary themes that emerged from the discussion was the recognition that climate risk is now a central business concern, challenging environmental consultants, lenders, and appraisers to determine how best to incorporate its consideration into traditional underwriting processes. Suzy Gardner noted the powerful market force that is demanding attention: “The single factor that brought climate to the forefront is the dramatic increase in insurance. The profit that insurance companies have made in the past 20 years has been wiped away in just four years. The rate of increases is moderating, but insurance costs are exorbitantly high—or even unavailable in some areas with greater exposure to climate risk.” As a result, the environmental due diligence, CRE lending, and valuation industries can no longer afford to ignore the reality: Climate risk is a business risk.

Regulatory Pressures and Practical Challenges

The lending discussion addressed the increasing regulatory pressures that are challenging banks to consider how best to incorporate climate risk into their risk management frameworks. Although regulators like the OCC (Office of the Comptroller of the Currency) are requiring big banks to manage the physical and transition risks of climate-related financial risk, the biggest challenges are the lack of standardization and variation in climate risk scoring systems. The regulatory push is essential in driving banks to develop more sophisticated methodologies for managing climate-related financial risks within their CRE portfolios.

Climate-related risks can impact a bank’s cash flow like capital expenditures, insurance rates, and regulatory fines at the loan and transaction level, such as those related to new energy benchmarking and building performance requirements. The first step many banks took was to conduct portfolio-based climate risk analysis. The next step is now to integrate climate-related physical and transition risk into credit risk policies and perform climate risk due diligence at the transaction level. Larger banks are in the initial stages of trying to operationalize new practices, but it is not without its challenges, including how to collect data consistently and incorporate these data sets into standard bank processes.

The Impact of Data Abundance

Rich West, Head of Valuation at AEI Consultants, further emphasized the urgency of addressing climate risk with the wealth of data now available. “The challenge is that the landscape has shifted from a period of data scarcity to one of arguable data abundance. There’s urgency, but there is a lack of consistency in how data is analyzed and rated. The good news is that we are starting to see the emergence and application of building resiliency scores and their impact on appraised values,” he noted. This shift underscores the need for a more holistic and standardized approach to property valuations.

The Need for Data Standardization

A recurring challenge mentioned by panelists was the lack of standardized data, which complicates climate risk assessment methodologies. Becci Curry, Head of Quality & Risk Management at CBRE, addressed the practical implications for property appraisals and valuations, noting the industry’s struggle with appraising for short-term and long-term valuations due to the impacts of climate risk. “Agreeing on standard data points for measurement and understanding their relationship to value assessment is essential,” she remarked.

From an appraisal standpoint, “there are the obvious things that might impact an appraisal. For instance, when insurance premiums increase, it negatively impacts your NOI (net operating income) which has a downward impact on value. There is also the impact of physical damage caused by a natural disaster which could mean downtime for a building or lost rent. These are short-term risks that can be solved like a math problem. Longer-term, however, the valuation impacts are less clear and less defined,” explained Curry.

Curry also discussed the concept of “stranded assets,” where buildings lose value due to prohibitive fines and costs associated with failing to meet building performance standards. For owners and lenders, the challenge is in determining whether the cost to remediate a property that is not compliant with energy, or emissions regulations become so expensive that the best option is to allow the property to obsolesce. “The industry needs concrete data and evidence that allow climate risk to move from being thought about in an abstract sense to being expressed in terms of real costs. That sea change is real and underway,” Curry said.

Opportunities in the Changing Market

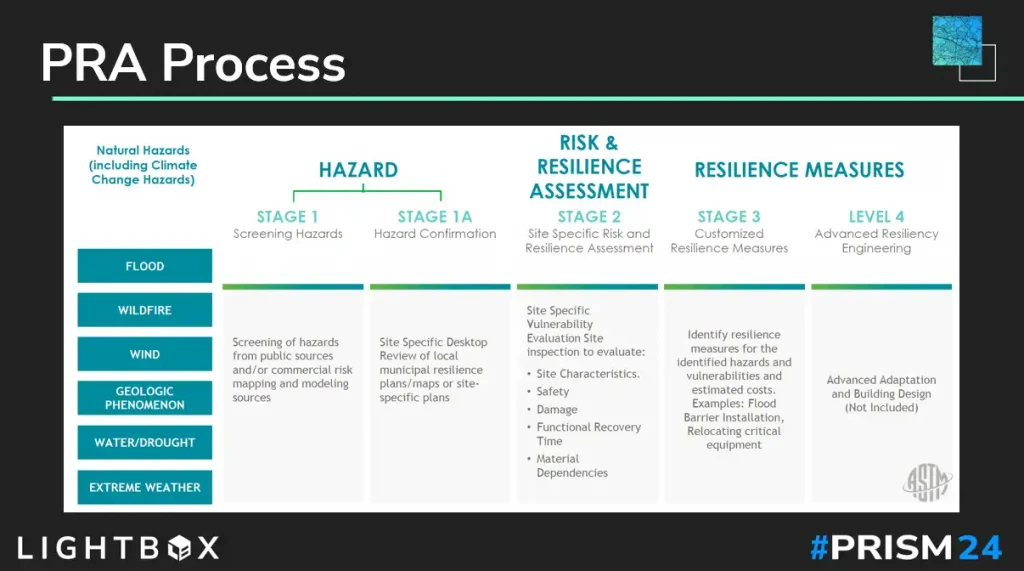

Despite the challenges, the panel also identified significant opportunities for investors who understand the possible impacts and apply this knowledge in creative ways to mitigate property risk. West noted, “Investors managing portfolios are asking how to maximize the value of their portfolio over the long-term by retrofitting, mitigating risk, and even realizing insurance rate reductions as a result.” He expressed confidence in the market’s ability to evolve: “I have great faith that the market will help solve this by giving us the processes and tools and data that will allow lenders to make loans and investors to buy buildings with a thorough understanding of climate risk implications.” The ASTM Property Resilience Assessment (PRA) standard will be a crucial step toward standardizing the way that lenders and owners can assess physical risks like wildfire, sea level rise, severe storm, and other risks at the property level as part of due diligence (see slide).

Coordination will also be critical. Curry noted that “When it comes to banks meeting the OCC requirements and the work I’m seeing from environmental consultants with regard to physical resiliency assessments, it seems to me it will be really important for appraisers to be connecting with their clients to understand what information is available so that appraisers can properly assess the true impact to value.”

It will also be interesting to see how the insurance industry continues to respond to the growing prevalence of billion-dollar climate events. The panel discussed the emergence of parametric insurance, the insurance industry’s new response to the increase in billion-dollar climate events. This insurance offers coverage if certain pre-defined event parameters are met or exceeded (e.g., a category 4 hurricane or cumulative rainfall above a set threshold).

Adaption is Key to Move Forward

The PRISM 2024 panel underscored the critical importance of integrating climate risk into all aspects of CRE decision-making. With regulatory and business pressures becoming more urgent, the CRE industry must adapt quickly. As Gardner succinctly put it, “We are dealing with a new reality. We as an industry need to quickly figure out how to deal with it.” The insights and strategies discussed at PRISM provide a roadmap for navigating this complex and rapidly evolving landscape.

Disclaimer. The views expressed by any persons during this presentation are their own and their appearance on the program does not imply an endorsement of them or any entity they represent. The information provided during this presentation is neither a legal interpretation nor an endorsement or recommendation by any entity. Views and opinions expressed by a current or former Federal Deposit Insurance Corporation (FDIC) employee are those of the individual and do not necessarily reflect the view of the FDIC or any of its officials.