CRE industry navigates growing headwinds, braces for wave of distress

Among the trends shaping the CRE market are:

- The LightBox CRE Activity Index was flat in Q3 2023 as commercial real estate lending and deal volume remained muted.

- The Mortgage Bankers Association (MBA) expects commercial property lending to fall 46% this year as traditional lenders remain on the sidelines and other debt and equity sources move to the forefront.

- The market is bracing for a wave of loan maturities that could create sizable distress as owners struggle to refinance in a higher rate environment.

As year-end approaches, the pervasive uncertainty that has gripped the commercial real estate industry for the past 20 months continues to shape decision-making. The impact from higher interest rates has led to a deceleration in commercial property pricing, but not the widespread pricing reset that will help define the path forward. With property valuations in flux and many traditional lenders on the sidelines, how is the industry navigating toward 2024 – and a sizable wave of loan maturities that could further upend the market?

Market indicators show resilience with an abundance of caution

While the Fed took another pause from interest rate hikes at its November meeting, Chairman Powell signaled that the tightening cycle is not over yet. The fallout from 11 rate hikes since March 2022 has cast a cloud over the industry, most notably by suppressing deal flow and making debt capital more expensive. The persistent bid-ask spread between buyers and sellers is complicating the necessary pricing reset that will bring more clarity to valuations – and entice more investors back into the market.

There is approximately $200 billion in dry powder designated for the U.S. commercial real estate market, according to data analytics firm Preqin. The challenge, however, is that many owners are opting to hold onto properties rather than sell at the bottom of the market, notes the Counselors of Real Estate. Commercial real estate prices have dropped an average of 16% since their peak in March 2022 and could fall further given the recent rise in Treasury yields, according to Green Street. This scenario of limited sales transactions is creating artificially low pricing levels and exacerbating the stalled investment environment. Capital sources are not likely to move into play for another six to 12 months as more clarity about future interest rates comes into focus.

LightBox leading indicators for CRE deals reflect a market on pause

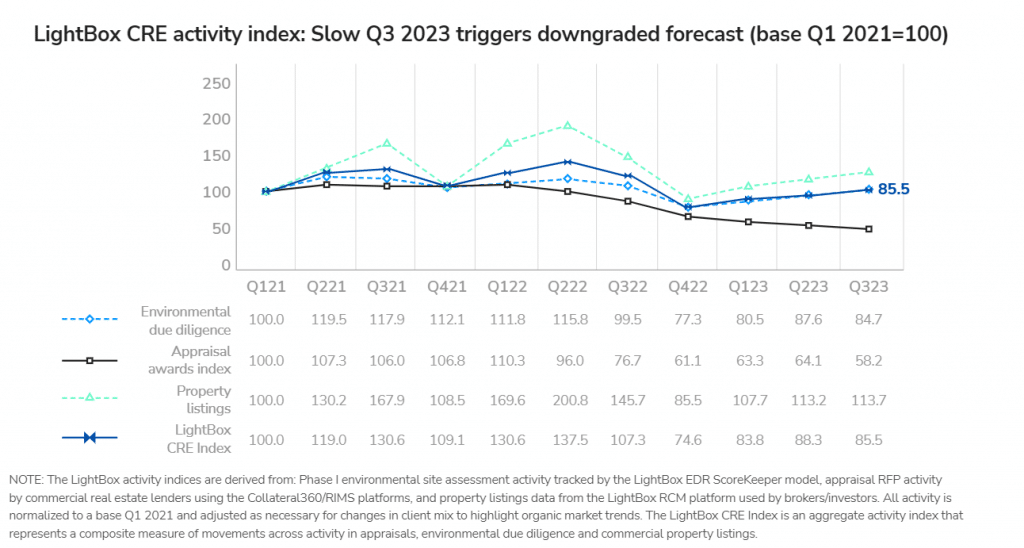

According to the LightBox CRE Activity Index, year-over-year activity slowed for all three activities tracked – commercial property sales listings, appraisal RFPs by commercial real estate lenders, and environmental due diligence activity. The composite index came in at 85.5 for 3Q 2023, just below 88.3 in the prior quarter and, as expected, well below 107.3 one year ago.

Although property listings, a barometer of sellers’ willingness to come to the table, maintained a stable rate over the past three quarters after recovering from a slow 4Q 2022 (85.5), activity is still well below the 2Q 2022 high water mark (200.8). Lender-driven appraisal activity remains well below the 1Q 2022 peak (110.3), reflective of lenders’ retreat to the sidelines as interest rates climbed. Environmental due diligence activity, as measured by Phase I environmental site assessment volume, is following a similar path of moderate 2023 activity after peaking in 2Q 2022 (115.8).

Lenders prepare for uncertainty

With third-quarter earnings results as a measure, the banking sector has stabilized after a tense period earlier in 2023 when three banks failed, and more appeared to teeter on the brink of government seizure. Although quarterly results have been better, many lenders are heeding the Fed’s warnings1 about a market correction triggering potential losses in commercial real estate and are responding by beefing up their provisions for credit losses. Additional provisions for credit losses and higher deposit costs are putting downward pressure on bank profits. “It’s a tough time in banking because margins are lean and the appetite for lending in most property sectors has declined,” said Candi Coleman, Head of Lender Strategy, Lightbox. “Now more than ever, banks are forced to look at the risk profile of their portfolios and all the assets behind their loans.”

As traditional lenders moved to the sidelines, other equity and debt sources are leveraging their funds to support owners as they navigate current conditions. “Most traditional buyers for institutional assets are sidelined until they see rates come down – higher for longer is a real concern,” said Marc Perusse, President and CEO or E3M Ventures, an opportunistic debt and equity investor based in Denver, CO. “We are definitely seeing things trading, but volumes are down more than 50%, depending on the market and asset class. Smaller assets of about $20 million and less have been more resilient and liquid.”

In the company’s subordinate debt business, the quality of sponsors and deals have improved from where we were three months ago. “A lot of sponsors are starting to recognize they have issues, especially if they have maturing debt, debt with margin calls due to new LTV or DCR calculation, floating rate debt, or other conditions,” he said. “The majority of people who have transacted in last three to four years, regardless of equity class, have impaired assets because of today’s interest rate environment, and this has increased investors’ expectations of returns across the entire capital stack.”

Office falls the farthest; Distress on the horizon

Among the greatest risk impacting the near-term forecast is the expectation that distressed assets will need to be dealt with in an environment of high interest rates combined with falling property values. A review of property data shows that, not surprisingly, office properties lead the pack for loan losses (although there is wide disparity between Class A and Class B/C office). Given the widespread disruption in office occupancy levels during the pandemic and the stickiness of the work-from-home sentiment, many office properties are struggling with occupancy levels ranging from 50% to 70%.

With valuations in flux, investors are waiting for a wave of CMBS loan maturities, projected at more than $4 trillion over the next three years. CBRE estimates that losses on commercial real estate loans could reach $125 billion over the next few years, with office loans reaching about $50 billion. This translates into approximately $60 billion in bank losses across the various property sectors. The market is bracing for a reckoning that will accompany the wave of 2024 loan maturities under challenging market conditions. Preliminary results from LightBox’s October Market Sentiment survey indicate that 45% of respondents are already seeing distress in their areas with one noting that “previously distress was mainly with downtown office, but now we are seeing in in outlying suburbs as well.”

Climate risks come to the forefront

Another stress factor for property owners, investors and lenders is climate risk, a topic that is gaining more attention as the severity and frequency of extreme weather disasters continues to climb.

“Every time there are major forest fires in a region or severe hurricanes or tropical storms, banks are challenged to look at their concentrations and their portfolios to determine how hard of a hit they are going to take,” said Coleman.

An important offshoot of climate risk is its impact on property insurance costs and availability. “It’s not just impacting those in climate risk areas or areas with extreme weather events,” said Coleman. “It’s impacting the entire industry. Insurance rates have increased exponentially due to extreme climate events. You have banks looking even more closely at the operational income and expense capability of any property, particularly if it’s located in a higher risk area for extreme weather or climate concern.” Lenders can expect more pressure from regulators to pay attention to the impact of climate-related risks on properties used as collateral, particularly in coastal regions. In its latest Financial Stability report [see footnote], the Fed recognized the growing importance of climate risk assessments by lenders and committed to “identifying the appropriate data and tools needed to assess climate-related financial risks that could affect the goals mandated to the Federal Reserve by Congress.”

Anything but normal

Normally, the fourth quarter is the busiest quarter for commercial property deals, but today’s market is far from normal. The MBA predicts that total 2023 commercial and multifamily lending will fall to $442 billion this year, a significant 46% decline from 2022 levels due to the rise and volatility of interest rates, the low number of transactions and the related lack of price discovery. While these factors are likely to exert downward pressure on lending volumes in the new year, the MBA forecasts a 2024 rebound in lending of 26% next year, contingent on a lowering of rates beginning to take root late in the year. If that happens, it is reasonable to expect the market to begin to pivot as more properties go on the selling block and the tight hold on capital loosens. As the market shifts, the LightBox CRE Activity Index will be an important barometer for tracking how functions like lender-driven appraisals and environmental due diligence respond. The results of LightBox’s market sentiment survey (to be released later this month) will profile how the sentiment of brokers, investors, lenders, appraisers, and environmental consultants has shifted since our May survey and reveal reactions to the myriad headwinds that will impact the near-term forecast.

1The Federal Reserve’s October 2023 Financial Stability Report, based on a periodic survey by the Federal Reserve Bank of New York, highlights the growing challenge of valuation uncertainty and the potential for large losses on commercial real estate and residential real estate ahead.