The current narrative surrounding the office segment leans more heavily towards doom and gloom than on the opportunities that this segment presents at this stage of the commercial real estate (CRE) cycle. News stories often focus on the record-high vacancy rates, high operating costs, falling rents and valuations, and shrinking leases as employers reduce their office footprint. The good news is that recent data suggests that the office market is not as dire as it may seem, and that a growing number of potential investors have office properties in their investment strategy.

Peak NDAs for Some Office Properties Challenge Perception

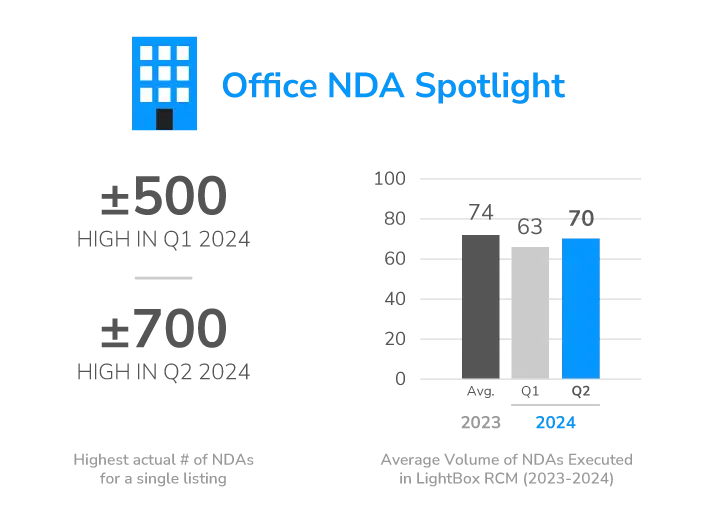

Each quarter, LightBox analyzes individual commercial property listings brought to market on LightBox RCM to identify those generating the highest number of non-disclosure agreements (NDAs), a reliable metric for where investors are focusing. In Q2 2024, the average number of NDAs across all asset classes rose to 105 above 99 the prior quarter, and in office, the average number of NDAs rose to 70 from 63 in Q1. Perhaps more interesting is that the single listing in Q2 that accounted for the highest overall number of NDAs was not an industrial property or a multifamily building. It was a low to mid risk office building in Texas that attracted more than 700 NDAs, a staggering 10x the national average. Also worth noting is that in Q1 2024, the distinction for highest NDA volume also went to an office building, this time in Arizona, that attracted over 500 NDAs.

These examples are important because they challenge the perception that the office sector is universally struggling. While some segments, particularly Class B/C downtown buildings with high vacancies and outdated amenities, face challenges, the latest NDA data shows that investors are looking at available office listings in their quest for ROI and new investment opportunities.

Uptick in Big Portfolio Sales Signals Market Life

As transaction volume in CRE begins to recover, a significant transfer of office assets is expected, either through forced sales or more traditional deal-making for assets in strong locations. “Among the more encouraging signs recently has been the uptick in big portfolio sales, the fact that there are multiple bidders for many distressed office sales, and that property sales are taking place across all segments of the market. We talked extensively on a recent podcast, The CRE Weekly Digest, about the fact that buyers are no longer waiting for another leg down in property values. They are putting cash to work which is a great sign,” says Manus Clancy, Head of Data Strategy at LightBox.

As leases for office space expire, tenants are revisiting space needs and location. In one promising development, national office leasing activity for the second quarter increased by 15% quarter over quarter, reaching its highest level since Q1 2020, according to JLL. CBRE’s initial data for 26 major U.S. markets shows positive net absorption for the first time since late 2022. “A broader office recovery certainly appears underway but especially in the Class A office segment,” Clancy adds.

Notable Lease Renewals Point to Office Market Confidence

For every story about a company reducing its office space, there’s another about a tenant expanding their footprint, sometimes in a different, more appealing office space. Several significant leasing and sales transactions provide the latest evidence that the transfer of office assets is getting underway.

In Philadelphia, for example, the Defender Association renewed its lease for 117,000 square feet at the Packard Building, expanding its office footprint by an additional 21,000 square feet. This renewal, one of the largest office deals in Center City this year, challenges the conventional thinking that office leases are shrinking. In some instances, tenants are renewing leases for larger square footage, particularly for spaces in desirable metros with modern amenities that will appeal to the employee base.

In Houston, Bechtel, a leading engineering and construction management firm, expanded its lease by 108,724 square feet at CITYCENTRE, a mixed-use development. This expansion was particularly noteworthy as it reflects a major construction firm’s confidence in the market by inking a deal for more, not less, office space.

In Midtown Atlanta, Colliers renewed their 40,000-square-foot lease at Promenade Tower. Cousins Properties, the landlord, reported increased interest and higher rental rates for its “lifestyle buildings,” which combine office space with amenities that enhance employee well-being and productivity.

Opportunistic Investors Deploying Capital in Office

So far, 2024 feels like it could well be viewed in hindsight as a critical turning point for CRE as investors move back into action. The office sector is unique as the period of adjustment to lower demand, the transformation to more attractive office space and, in some cases, a transfer of distressed assets will lead to losses for some and opportunities for others.

One area of office that is also gathering steam is the redevelopment of obsolete office space into other, more desirable uses like apartments or condominiums. One recent example is PMC Property Group’s purchase of Three Parkway in Philadelphia for $30 million, with plans to convert the office building’s vacant space to residential, adding to the growing list of office-to-residential conversion projects in Center City. Philadelphia-based PMC expects to convert the lower half of the 20-story building into approximately 175 residential units. MRP bought the building for $95 million from Dallas-based Tier REIT in 2017 when it was 86% occupied. Now, the office building is 40% occupied, according to brokerage firm JLL.

A Market in Flux, but Far from Down

Despite the encouraging signs of recovery, the office market still faces significant headwinds. High vacancies, particularly in older, less desirable buildings, continue to challenge the sector. The shift towards remote and hybrid work models that started during the pandemic has reduced overall demand for traditional office space, forcing landlords to innovate and repurpose their properties to attract tenants. Additionally, rising interest rates and economic uncertainties could impact investor confidence and financing conditions, potentially slowing down the momentum of market recovery.

However, these challenges are being met with creative solutions and strategic adjustments. Property owners are investing in renovations and upgrades to make their spaces more attractive and competitive. “A broader office recovery certainly appears underway, especially in the Class A office segment,” noted Clancy. The office market’s resilience and renewal are clear, making it an exciting time for stakeholders and observers alike.

For a more in-depth analysis and insights focused on capital markets and investment trends, check out the LightBox Quarterly CRE Market Snapshot.