Guest Author: Mike Flood, President, MF Policy Advisors

This week, I’m sharing my perspective on where I think the Administration is headed with Fannie Mae and Freddie Mac’s (GSEs) conservatorship. With FHFA Director Pulte’s swift actions, I’ve received many questions regarding where GSEs will end up in four years. Remember, the two giants own roughly 50% of the multifamily finance marketplace—so movement here shows up everywhere. Of course, not everything is clear just yet—which makes it all the more important to separate what I know from what I’m still waiting to learn.

The Knowns: Privatization Remains the North Star, but Don’t Expect Lift-off Just Yet

- The First Trump Administration Took Serious Steps Towards Removing the GSEs from Conservatorship: Then FHFA Director Calabria’s agenda focused on improving the capital and regulatory positions of the agencies to prepare for a potential path to privatization. The preferred stock purchase agreements (PSPAs) had been amended to put the GSEs in a position to exit conservatorship (though the Biden Administration paused these moves). Some viewed this amended agreement as an 11th hour push to privatize the GSEs.

- Current FHFA Director Pulte’s Statements: “Fannie and Freddie shouldn’t be in conservatorship forever, but it’s critical to ensure any discussion about exiting conservatorship needs not only to ensure safety and soundness but how it would affect mortgage rates,” said FHFA director Bill Pulte. I interpret this as the Administration viewing privatization as the end goal and continuing to orient the GSEs in that direction. However, it is not the first priority, and actual privatization may not be attempted immediately, if at all.

- The Second Trump Administration—Personnel Carryover: Housing personnel from Trump I that pushed the GSEs towards the exit are part of Trump II. Former FHFA Director Calabria holds a key role at the White House’s Office of Management and Budget (OMB), a current power center in the Administration. FHFA’s general council served during Trump I at FHFA.

- FHFA’s Current Goals:

- Root out fraud, waste, and abuse at the FHFA and GSEs

- Efficiently run organizations, and focus on the mission of producing affordable housing

- FHFA’s Notable Actions:

- Ended programs focused on DEI, and cancelled regulations focused on environmental and certain lending programs (i.e. special credit purpose programs, equitable housing programs, fair housing programs)

- Removed and replaced Board members at both GSEs. Appointed self as Chair.

- Eliminated 100 employees at Fannie involved in fraud.

- The Administration Can Remove the GSEs from Conservatorship Without Congress…. but There’s No Guarantee (see what I did there?):

- Yes, the FHFA Can Remove the GSEs from Conservatorship on its Own. Remember, we’re not talking about full-scale housing finance reform. We are talking about taking two companies out of regulatory trouble and returning them in some form to the state they were in—before conservatorship—only stronger. This is a common process in banking.

- It Takes an Act of Congress to Provide the Full Faith and Credit of the Government Behind any GSE Security: If policymakers want to provide an explicit guarantee on GSE securities, then Congressional action would be required. However, the GSEs can be released from conservatorship with the implicit guaranty afforded the securities prior to the Great Financial Crisis without an act of Congress.

The Unknowns: The Endgame for Fannie and Freddie Remains Murky

- What Will the GSE’s Business Look Like, and Who Will Run Them? While we see the immediate actions of the FHFA to eliminate fraud and regulation, the end game is unclear at this point. The Administration wants the GSEs to exit, but they also do not want to cause disruption to an already costly (to the consumer) housing market.

- Will the Administration Try to Remove them from Conservatorship Without a Guarantee? Welcome to the guessing game. While only Congress can provide a full faith and credit guarantee from the U.S. government, the big question is: would the market accept Agency securities without it? And if not, what impact would that have on interest rates for apartments and single-family homes?

- Will the Market Accept GSE Securities Without an Explicit Government Guarantee? How would GSE securities investors react to an implicit guarantee? Would they purchase the securities? At what price? How would mortgage rates react?

- How will the FHFA oversee the GSEs During the Next Four Years as it Relates to Multifamily? Well, I’m glad you asked (through my own rhetorical question). Well done! Stick with me—I’ve got a full breakdown on what this all means for multifamily, from rent caps to regulatory resets.

Core Beliefs and Past Actions Speak Volumes:

- Capitalism as the Driving Force for the Economy. While this is not the typical GOP Administration, the President is a businessman. Many private sector lenders believe that the GSEs are crowding them out in the areas where the involvement is not necessary for the marketplace. Banks would certainly like a larger share of market-rate loans that currently flow to the GSEs—and many have argued that loans made to borrowers above 80% Area Median Income (AMI) should be considered market rate. Further, during an April 9th interview on Fox News with Maria Bartiromo, JPMC CEO Jamie Dimon questioned why 80% of the mortgage market flows through the agencies via non-bank lenders rather than regulated financial institutions.

- Nonbank Model Questions: During the first Trump administration there was notable skepticism about non-bank liquidity—particularly during the COVID-19 crisis. The administration raised questions about whether large residential servicers should be designated as Systemically Important Financial Institutions (SIFI)s, and whether non-banks should be subject to comply with community reinvestment act requirements. Note: These are concerns often voiced by regulated institutions, regardless of whether the playing field is the same for both structures (i.e. one has deposits, one does not).

- Trump I’s Multifamily Actions Shrunk the Footprint. Highlights include:

- Seller/Servicer Strength: A reminder of the heightened focus on servicer oversight, asset management, and liquidity. The FHFA wants to ensure that taxpayer money is not at risk for fraudulently underwritten or processed loans.

- Improving the capital position of the GSEs: The Trump administration finalized the capital rule for the Agencies (and since amended by the Biden Administration).

- Focusing the Agencies on Affordability: Trump I removed all exceptions to the multifamily lending caps, increased the percent share of GSE multifamily business required to support affordable housing, and removed high-cost area exemptions from the 80% AMI definition used to generically classify affordable units.

- PSPA Adjustments: Though paused by the Biden Administration, Trump I amended the PSPA agreements to (a) create a permanent $80B per Agency per year cap on multifamily lending (with an annual CPI adjustment), and (b) removed a seasonality aspect of planning for multifamily lending.

Where Does Multifamily Business Go from Here?

Consider the facts: (a) The Administration wants to end conservatorship. (b) The Administration is not prioritizing it right now (lots of fish to fry if one even sniffs the news), (c) The Administration doesn’t need another effort that may potentially increase prices at the moment, and (d) The Administration has four years, and does not have to run again. So, with these facts in mind, I believe we see the following for GSE multifamily housing over the next four years:

- Increased Focus on Affordable Rental Housing:

- No exceptions to the multifamily caps, meaning all multifamily loans—including affordable and mission-driven—would count toward the cap.

- Higher percentage of capped volume directed towards affordable housing.

- 80% AMI requirement across the board with no exceptions for high-cost areas (e.g. 120-140% in NYC likely goes away).

- Strong annual justification needed to raise multifamily caps.

- Opportunity Zones—HUD Secretary Carson and Senate Banking Chair Scott are both “opportunity zone fathers.” I’d expect to see programs that incentivize lending in opportunity zones.

- Workforce Housing—The Biden Administration released a workforce housing program that has seen small uptake by GSE lenders. Considering the Trump administration’s populism, I’d expect a review of this program.

- Rent Caps Could be Discussed—If affordability continues to be an issue, then rent caps could be a point of discussion for government backed loans. While unpopular as a potential policy solution, and never raised by the Trump administration, continued affordability issues could bring it back as large blunt policy tool to help low- and moderate-income Americans. The two reference points that make it feel that rent caps could be a policy talking point if affordability remains an issue are: (a) Trump I halted evictions during the financial crisis, and (b) Trump has endorsed interest rate caps on credit cards, which has gained a bit of bipartisan support via a co-sponsored bill.

- Focus on Core Multifamily Affordable Lending

- Removal of Programs Considered Extraneous or Unnecessary: Programs likely to be removed include DEI, social bond, climate, special purpose credit, and expanded fair lending programs.

- Focus on Primary Lending: Meaning first liens, Low-Income Housing Tax Credit (LIHTC) programs, and programs that directly support new construction, rehab, or the refinancing of affordable housing. FHFA will likely take a close look at programs that suggest the GSEs are leaning into the primary market—potentially including second leins and small balance loans.

- Fast-Paced Regulatory Environment: The continued push towards privatization will require rulemakings.

- The FHLB system: Questions will be asked about who should be eligible, and what type of collateral (i.e. should more than affordable housing be eligible) should be allowed.

- Personnel Changes at the GSEs: I’m not suggesting layoffs or firings. I’m suggesting that when a company has a culture change, employees also make decisions about whether that culture fits their needs. As the swing in direction occurs, so too, as a natural course of business, will personnel.

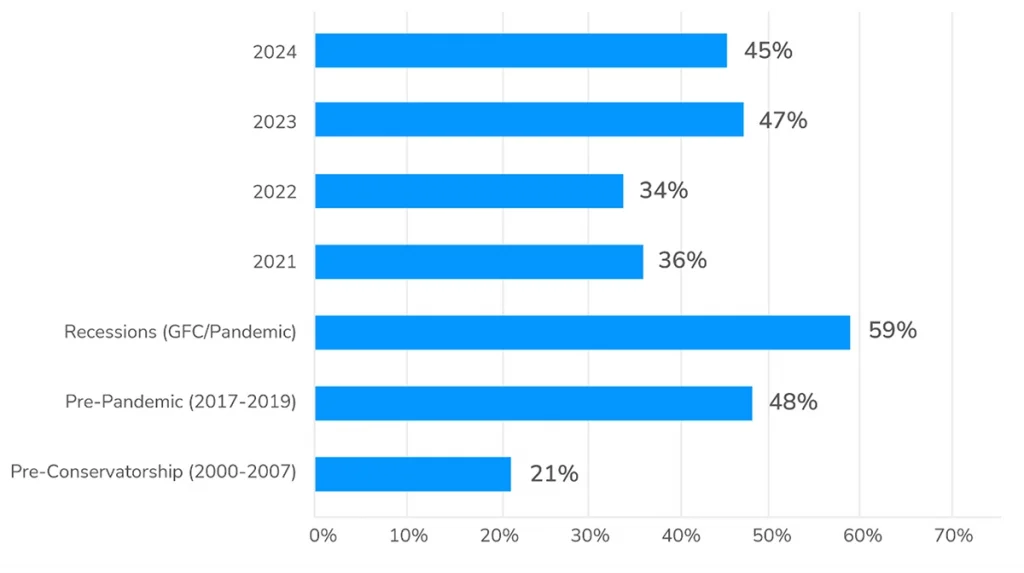

GSE Share of Multifamily Lending Activity

*Note: Based on the median home price. Assumes 20% down payment and excludes taxes, insurance, and monthly maintenance.

As shown in the chart above, GSEs have accounted for anywhere from 35% to 60% of multifamily lending since the Great Financial Crisis—a significant jump from their pre-crisis share of roughly 20%. If privatization moves forward, could we see a reversion to that earlier level? It’s a possibility worth considering.

Then There’s the Gamble That Could be Tried: So, will they or won’t they try to remove the GSEs from conservatorship without an explicit government backstop of the guarantees? You’ll dislike my answer, but I believe the Administration will “try”—if the situation is right.

The President has treated many of his policy decisions like negotiations. He believes he has been successful by exerting maximum leverage early on in a process to see what the other side will do. A prime example is the current tariff environment. The President rolled out a tariff program that dwarfed what every respected prognosticator thought. The markets are roiling, and we are receiving what feels like differing signals from the Administration as to the desired outcome. On the one hand, the President continues to escalate with the Chinese, and on the other tells the public how many countries are begging to negotiate. Late Friday, the Administration announced exceptions to the tariffs for consumer goods. Then announced that such an exception is a pause, and consumer goods will receive their own set of tariff rules in the future. The fundamental question still remains—does the Administration intend to negotiate with countries it feels are taking advantage of America as it relates to trade, or are we experiencing a long and potentially painful transition to a self-sufficient economy? It feels like the economy has guided some of the decision-making.

I can foresee an economic situation (say 2028) where the same strategy could be applied to GSE conservatorship. Let’s pretend the economy has settled into some sort of groove by 2027, and Americans are reasonably happy with their lot in life. Mortgage rates have settled, and the public is starting to transact again. Poll numbers are in the 40’s. In such an example, the Administration—notably, who does not have to answer to the public again—could strongly suggest to the press that the GSEs will likely be released from conservatorship in the near future. Then sit back and watch what the markets and politicians do.

Depending on the outcome of those reactions, the Administration can make up its mind on direction. ‘Yes, let’s go ahead, the market can handle it, and any perceived “pain” (economic or otherwise) is worth it.’ Or ‘no, the economy either isn’t ready and won’t accept it without a guarantee, or the pain threshold is too high. So let’s call it a day and declare victory because we have done everything we can to have them ready exit.’ Now it’s up to Congress to do its job. If that’s what is happening now on a global scale, why not try it on a “smaller” scale with the housing market?

Have questions or want to share your thoughts? Email us at insights@lightboxre.com and we’ll make sure it gets to Mike Flood. And don’t forget to subscribe to LightBox Insights to get the latest CRE policy updates and market analysis delivered straight to your inbox.