RIMS® (Real Estate Information Management System)

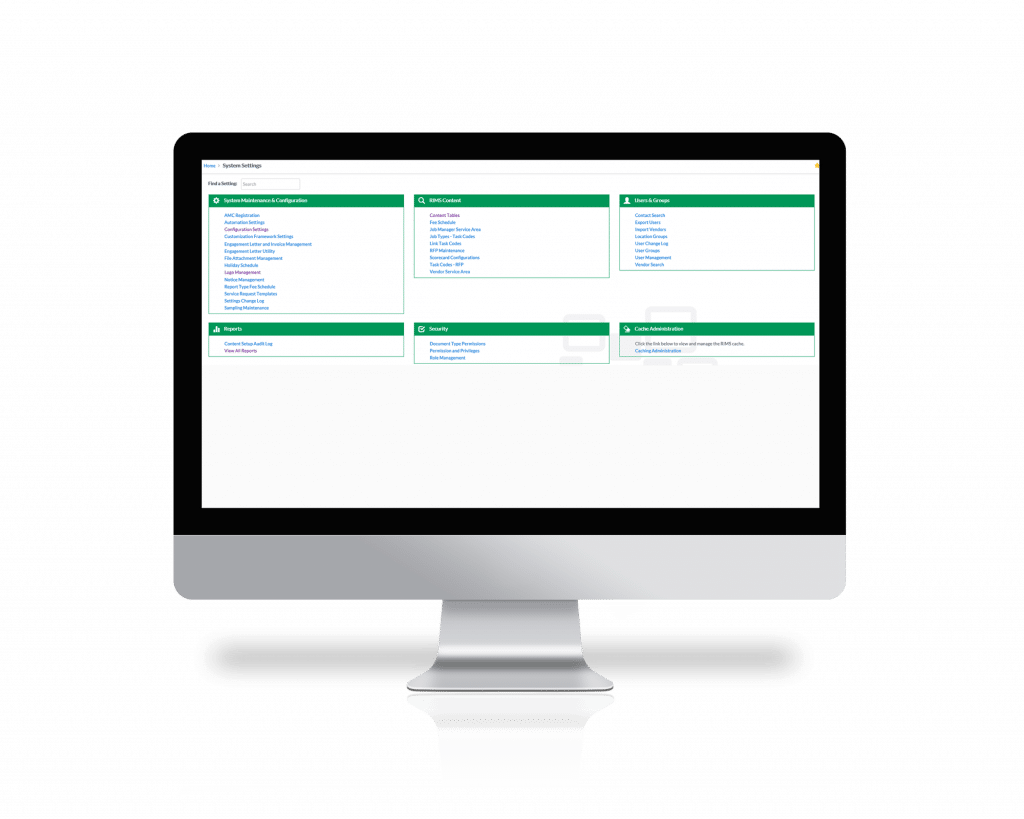

The technology platform supporting real estate lending due diligence workflows for appraisal, valuation, environmental, construction, and flood services. RIMS is a procurement and workflow management system that connects lenders with their preferred vendors and information providers in a secure, compliant environment.

Request A DemoStreamlined lending workflow

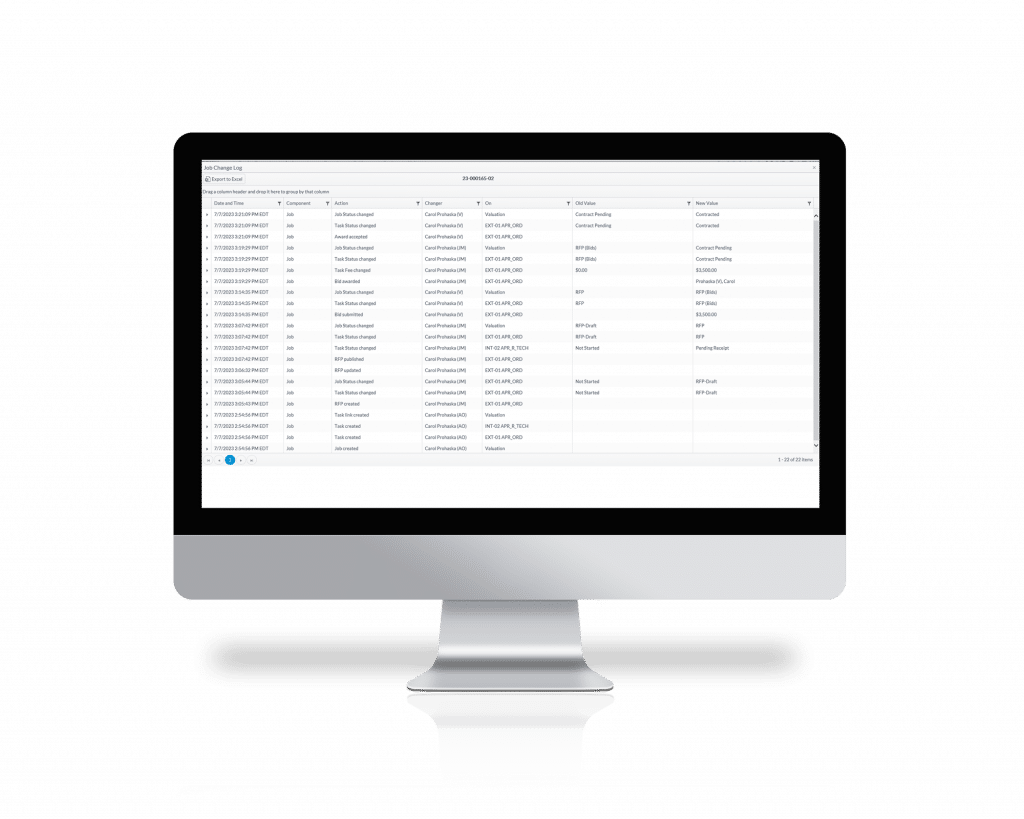

Lenders use RIMS to bid, award and manage appraisals, environmental studies, construction inspections, flood certifications and other due diligence services for commercial and residential real estate loans. RIMS is easily configurable to meet most lending workflow processes and has role-based permissions allowing employees to view and edit what they are allowed. Lenders using RIMS report efficiency improvements that lead to increased loan volume capacity without taxing existing staff.

Efficient Vendor Management

RIMS provides a compliant workflow solution for vendor management. Vendors use RIMSCentral, an online portal where vendors can securely acknowledge the assignment or submit a bid. The secure document collaboration allows lender personnel to upload assignment details for the vendors to view and download, and vendors are then able to safely upload their reports and invoices to the lender. Once submitted, the lender can evaluate the performance of a vendor using a detailed scorecard.

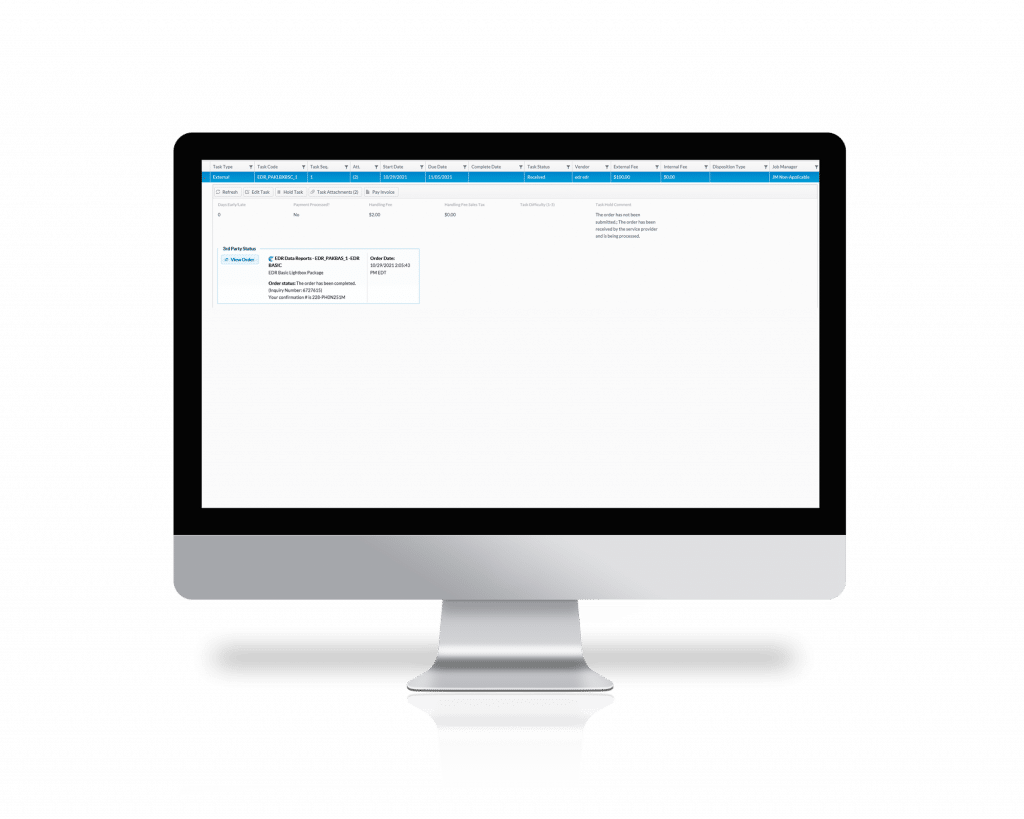

Reputable Catalog Partners

RIMS offers a wide range of built-in data and services from third-party sources including AVMs, evaluations, flood certifications, and custom market information reports from some of the most respected names in the industry. Lenders can integrate with these third-party sources seamlessly within the RIMS platform.

Residential Lending Automation

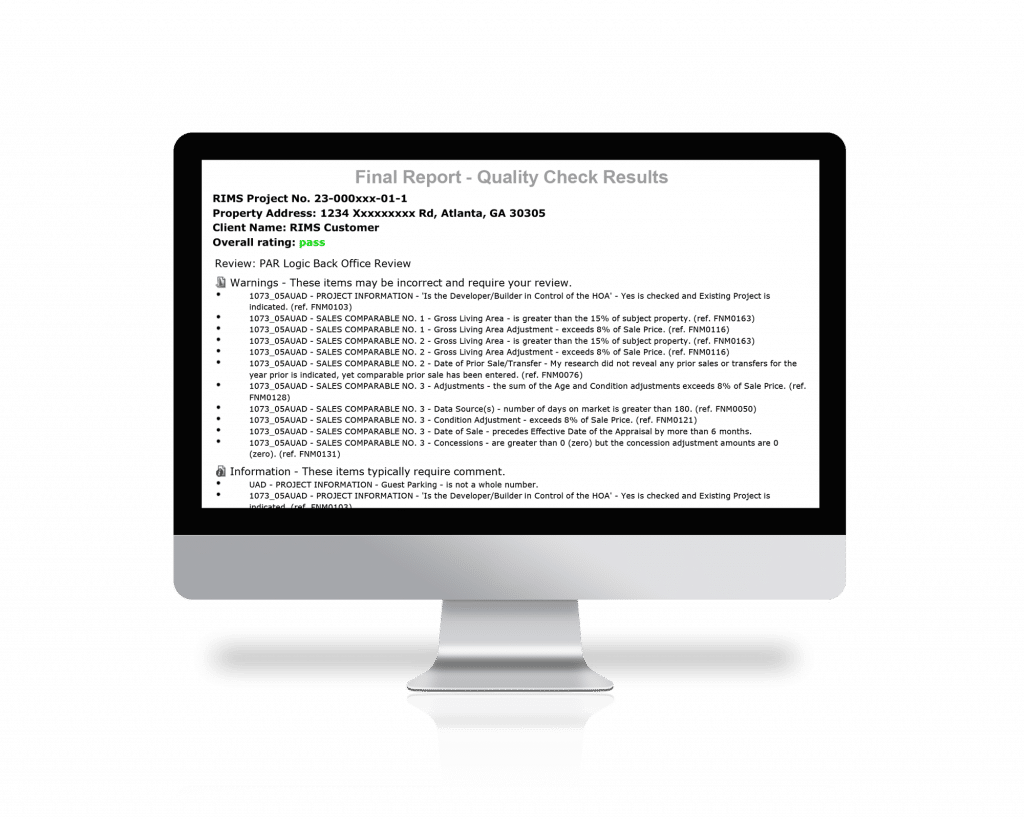

When it comes to residential workflows, RIMS offers customized auto-award capabilities, ranging from simple round-robin assignment to weighted assignment based on variables such as geographic proximity, experience, rating, and price. Lenders can opt-in for automated appraisal report rules checking, including UAD compliance and Fair Lending checking. There are four levels of automated rules analysis: Completeness, Correctness, Consistency, and Compliance. RIMS provides automated MISMO GSE file creation, UAD certification, and optional submission to UCDP(SM).

RIMS has a network of 62,000 bank users and 30,000 vendors on its platform. Our dedicated product managers, client success managers, and customer support team are committed to our clients and the continuous improvement of the RIMS product.

Key features include:

✔ Configured and streamlined workflow

✔ Regulated risk & compliance

✔ Reputable catalog partners

✔ Residential lending automation

Recommended Insights

LightBox CRE Monthly Commentary: CRE Remains Safe Harbor During Tariff-Induced Storm—Will It Continue?